INTRODUCTION

Upon the passage of HB19-1261 two years ago, the state legislature set in motion the regulatory process that promises to cut Colorado’s greenhouse gas emissions by half before 2030 and 90% before 2050. In January 2021, Governor Polis and several state agencies released the final draft of the “Colorado Greenhouse Gas Pollution Reduction Roadmap,” which establishes the policy recommendations by which the state might reach the targets of HB19-1261.

[i] Some Colorado localities, too, are considering and enacting ambitious environmental policies; regulators in Denver released a plan in January to effectively ban the use of natural gas in new buildings, for example.

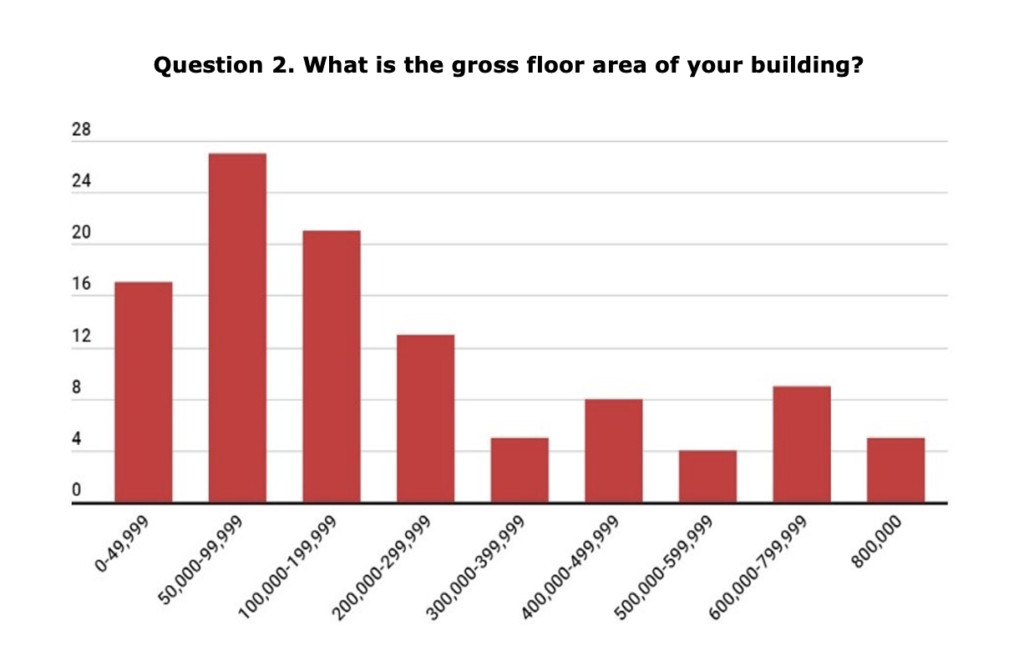

Among the Roadmap’s recommendations is the establishment of a statewide benchmarking and performance-standard requirement for large, especially commercial, buildings. To address this aspect of the Roadmap’s guidance, some legislators have drafted a benchmarking and performance mandates bill for the 2021 session which targets buildings over 50,000 ft2. If passed, it would launch a benchmarking (energy-use– and emission-reporting) program in 2022 and set energy-use standards to be met by 2026. Large-building–benchmarking programs currently exist in Denver, Boulder, and Ft. Collins, but these only require reporting and do not set explicit energy-use reduction rules.

This report summarizes the draft benchmarking and performance-standard legislation, and highlights concerns and the potential for unintended consequences that lawmakers and regulators should consider. It also presents important findings from a recent survey conducted by Common Sense Institute (CSI) in coordination with the Colorado Real Estate Alliance (CREA) and Building Jobs 4 Colorado; results of this survey can be found in Appendix A, and highlights from the survey are featured throughout the report.

Key Findings

- The Colorado Greenhouse Gas Pollution Reduction Roadmap suggests that benchmarking is a useful tool to identify areas of opportunity for demand reduction and electrification, yet a current draft benchmarking and performance standards bill includes mandated energy-use reductions before any data is produced suggesting what the unintended consequences, costs and even benefits might be of such mandates.

- In a survey of commercial building owners conducted in late February 2021, 45% of respondents indicated that they either cannot or are unsure if they can meet any of the performance targets prescribed by the building benchmarking draft legislation by making investments with positive return. Some common reasons indicated were that:

- Energy efficiency projects with positive ROI have already been exhausted,

- The existing and likely long-term impacts of COVID-19 on tenants makes large new expenses much more difficult and sometimes impossible to afford,

- Requiring a minimum Energy Star score presents compliance challenges, since each building’s score is determined based upon a ranking among all peer buildings nationally,

- Because Energy Star will update their scores based upon its latest 2019 survey, high scores may be more difficult to achieve after the performance standards go into effect,

- Some tenants control their own energy usages and may not care to assist their buildings’ compliance.

- Though the draft benchmarking and performance legislation does not directly prescribe building electrification, it is part of a broader effort to encourage it. There are several important costs which require further study to better understand the impacts of forced electrification:

- Until Colorado’s electric grid becomes clean enough, large-scale building electrification would actually increase the state’s total emissions. In 2019, Colorado’s electric utilities emitted 178% more CO2e than the average of residential, commercial, and industrial buildings for each equivalent unit of energy they generated.

- The extent to which local utilities can support rapid increase in commercial building electrification is limited. Analysis from Xcel Energy of residential electrification indicated that a rapid shift to electrification would force the electrical grid to increase its capacity by over 50% and cause rates for natural gas customers to increase by up to 88% over the current average.

- Many commercial buildings lack the physical space required to house electric power equipment and would need structural renovations to accommodate it.

- Many buildings have new power systems with many years of usable life left.

- Insufficient data exist to accurately project the economy-wide costs and consequences of the draft bill’s performance standards.

- Both tenants and commercial property owners face long-term financial uncertainties in the wake of COVID-19. Evaluation of new mandates which impose direct costs must consider not only the cumulative costs of other recent legislation, but the impacts the rules will have upon stakeholders recovering from the current economic downturn.

Though They Don’t Dictate a Specific Goal, Policy Recommendations Target Colorado’s Building Sector for Significant Emissions Reductions

The state’s analysis identifies Colorado’s built environment as one of the four major sources of its greenhouse-gas emissions and concludes that “meeting the state’s GHG targets will require [considerably] reducing pollution from buildings.” Though policymakers and regulators haven’t yet decided the specific magnitude of reduction they expect from the building sector, their primary aims are to encourage large-scale energy-use abatement and, eventually, large-scale building electrification.

Total emissions from Colorado’s buildings sector are rising and expected to continue to do so under current policy—naturally, this reflects the rapid growths of Colorado’s population and urban development—but buildings, on average, are becoming cleaner. In 2020, total sector emissions were 8.2% higher than it was in 2005, but the average commercial or industrial building emitted 4.4% less than it did in 2005 and the average residential building emitted 13.6% less.[ii] This indicates that technological advances are already occurring which enable buildings to operate more efficiently; unimpeded, this trend will proceed indefinitely.

Legislators and Regulators Should Be Wary of Establishing Performance Standards without a Foundation of Benchmarking Data

Colorado’s GHG Roadmap endorses establishing performance standards for buildings, but also argues that requiring building owners to report their properties’ energy-use levels and emissions can help the state identify what sort of standards it should set. This current draft legislation, though, would immediately impose mandates for near-term and future energy-use reductions prior to having ever collected any statewide benchmarking data. The Roadmap specifically identifies the challenges of setting reduction targets without sufficient data:

The immediate and persistent impacts of COVID-19 emphasize the critical need to ensure that new mandates don’t impose undue cost burdens. Many commercial property owners have endured reduced occupancy due to statewide restrictions upon in-person gathering, and many tenants, as they grow accustomed to increased reliance upon remote work or their businesses suffer privations through the ongoing recession, are also re-evaluating the amounts of office space they will require in the future. Since new costs imposed upon building owners are often borne by tenants, owners and tenants alike must be regarded as important stakeholders in these regulatory actions.

Building Owners Want to Remain Competitive AND to Be Good Stewards of Our Environment

Of the four sectors identified as major sources of emissions, the other three of which are transportation, utilities, and oil and gas production, the building sector presents a unique challenge for policymakers and regulators with objectives to reduce emissions. Regulating just the sale of vehicles with emissions standards, for example, still allows for an overall reduction in emissions within an aggressive timeline since the average lifespan of a vehicle is just 11 years. Though the move to reduce emissions from the electric grid will leave large generation assets stranded before the end of their useful lives, utilities are granted the authority to raise rates to cover the costs of new investments they make and to pay off assets no-longer-in-use. Buildings, conversely, are fixed assets which do not follow cycles of obsolescence like cars and cannot easily defray the costs of any new investment they undergo as utilities can.

Where there are cost-effective technologies or behaviors which can reduce a building’s energy use, property owners are strongly incentivized to pursue them. Reducing energy costs is good for business; however, rules which force owners to make reductions greater than those the market allows them to make economically harm businesses. Sympathetic legislators and the drafters of Colorado’s Roadmap insist that the energy-use reductions they would like buildings to make will save their owners money, but, the way that this draft bill’s performance standards are written, some building operators will have much harder times than others finding solutions which return positive value on investment. Each covered building faces a unique path to compliance if the bill passes, and lawmakers should consider it essential to have more complete information to help establish the best path forward.

Overview of Draft Bill’s Performance Standards and Penalties

As of March 5th, this bill has not been formally introduced, so its provisions are subject potentially to change. Under its current letter, an owner of a covered building is required to report to the state his/her properties’ energy use, energy-use intensity, electricity demand, greenhouse-gas emissions, and Energy Star score. This initial requirement of the draft bill is similar to current requirements in Denver, Boulder and Ft. Collins, and does not pose significant compliance costs.

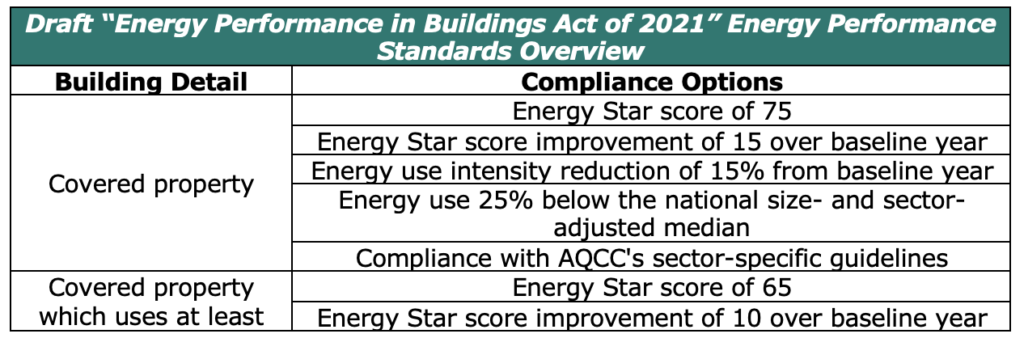

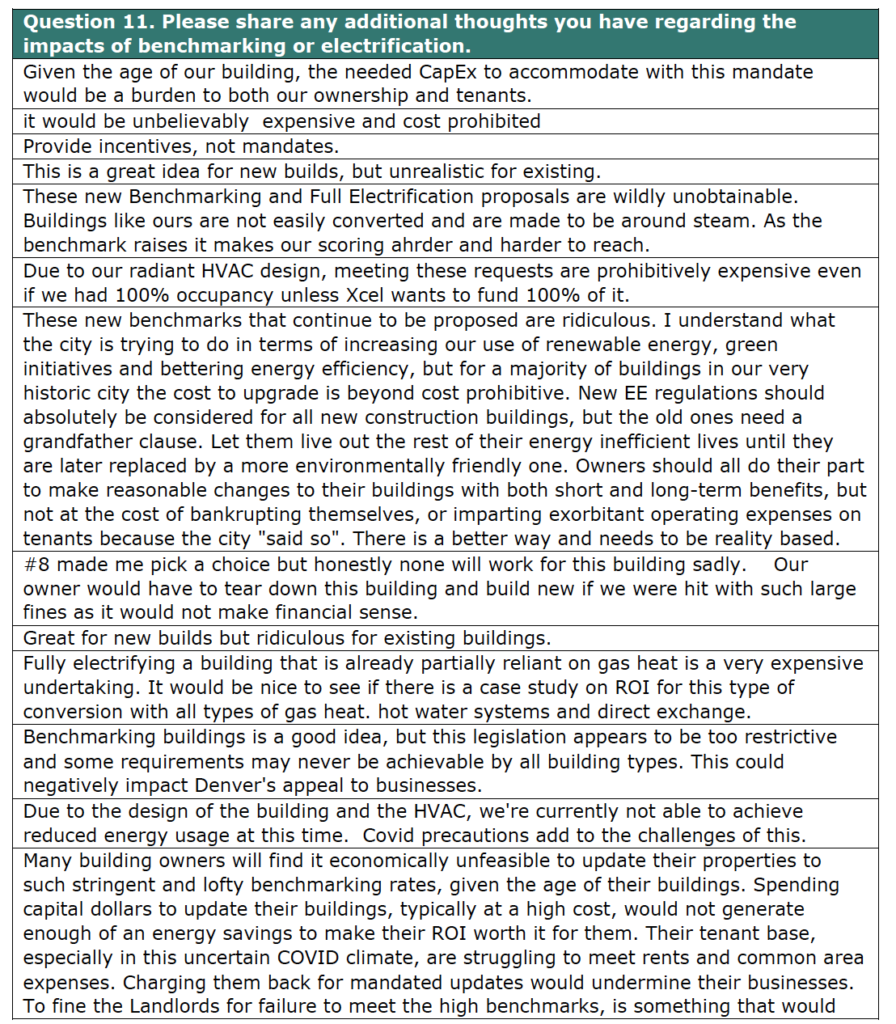

This draft bill departs from existing benchmarking programs in the state by imposing specific performance standards, or, energy reduction mandates. The five conditions of compliance with these standards, as well as the legislation’s special cases and exemptions, are summarized in the table below:

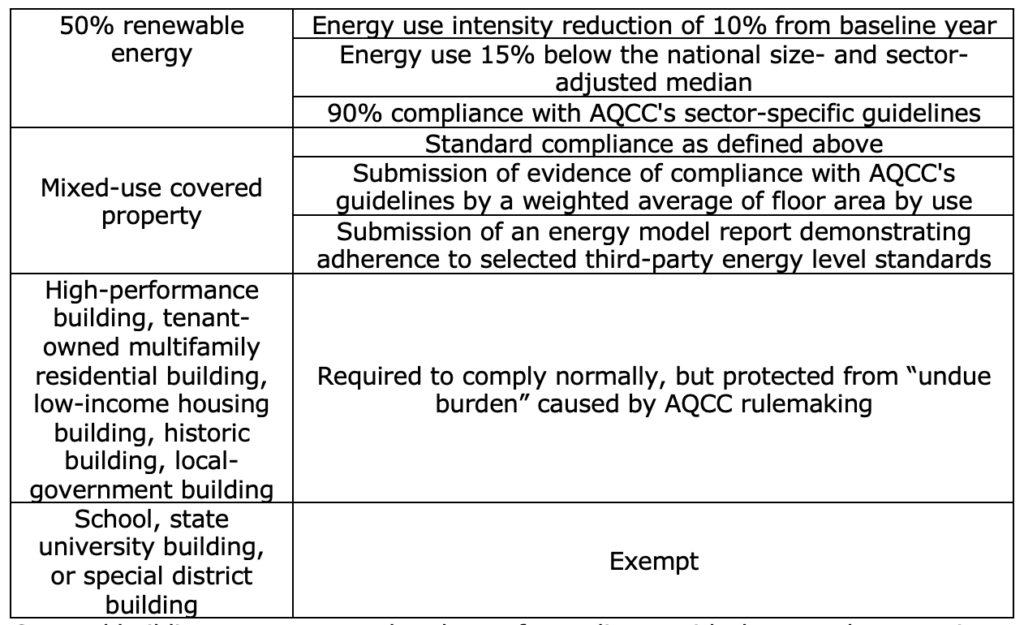

Covered buildings not exempted and out of compliance with these or the reporting standards are subject to monetary penalties. Every building required to report is also charged a small annual fee regardless of performance. The program’s fees and fines are summarized here:

Impact Areas of Mandates Included in the Draft Benchmarking and Performance Standards Bill

1. Mandates to Reduce Energy Demand Will Impose Unknown and Unequal Costs

Reducing a building’s energy usage decreases its energy costs, but forcing high levels of reduction with the threat of penalties may cause many owners to make financially-unsound investments or simply relent and suffer fines.

Much about the Cost to Reduce Emissions from Colorado’s Building Stock Remains Unknown

No source yet exists with enough data about Colorado’s built environment to capacitate any to know what the true reach of a statewide benchmarking bill with performance standards would be. The draft bill calls for the creation of database of covered buildings to understand their energy uses and system designs, yet also imposes performance mandates despite not having the data available to properly estimate what those mandates will cost or whom they will affect. Some, especially poorly-run, buildings can more easily reduce demand cheaply; others may not have the systems by which to do so; the bill accounts for this to some degree, but there’s no authoritative indication of the populations of either basket.

Even to the extent that local building counts exist, building-use provisions and exemptions in a benchmarking bill confound lawmakers’ abilities to understand the legislation’s impacts before the statewide database is compiled—in Douglas County, for example, the Assessor’s records show that 359 of the county’s 527,000 properties have gross floor areas at or above 50,000 ft2,[iii] but indefinitely many of these would be exempt from benchmarking and performance standards based upon their functions. It is not yet possible to estimate the true number of covered buildings in Douglas county (or all of Colorado, consequently), what their emissions or energy-use intensities are, or what it would cost them to comply with the draft bill’s performance standards.

The Equipment Required for Energy-demand Reduction in Many Buildings Is Potentially Very Expensive

Some building owners will be able to reduce their properties’ energy demands to compliant levels by making low- or no-cost changes. Others, though, may have to invest in expensive new equipment or advanced operations with no promise of ever reaping a positive return.

Energy-demand reduction necessarily decreases a building’s periodic energy usage and costs, but those savings do not always swiftly cover the initial costs of the measures required to achieve them. A study conducted by the consulting firm McKinsey & Company identified many demand-reduction strategies with positive net present values for large buildings and the initial costs associated with enacting them—of these, the average initial cost is $4.40 for every million Btu of demand reduced.[iv] Initial costs this high could prove prohibitive to such a degree that some owners may prefer to swallow fines rather than spend so much in the short term, as indicated by one participant at an early stakeholder meeting for the draft bill, and some buildings may have to take measures which are not cost-effective in the long run, but less expensive than the fines.

Even in cases in which owners can reduce energy demand cost-effectively, the costs of fitting buildings with new equipment and implementing new operational habits are not isolated. Energy-efficient equipment tends to be difficult to operate and many operators would require extensive re-training in order to handle it properly.

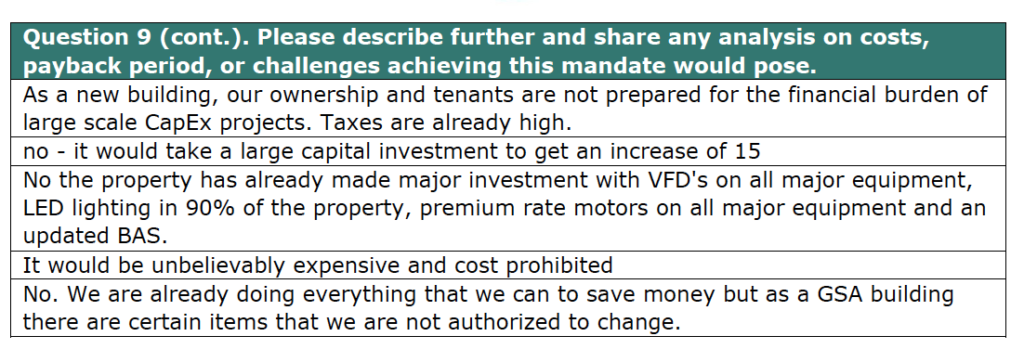

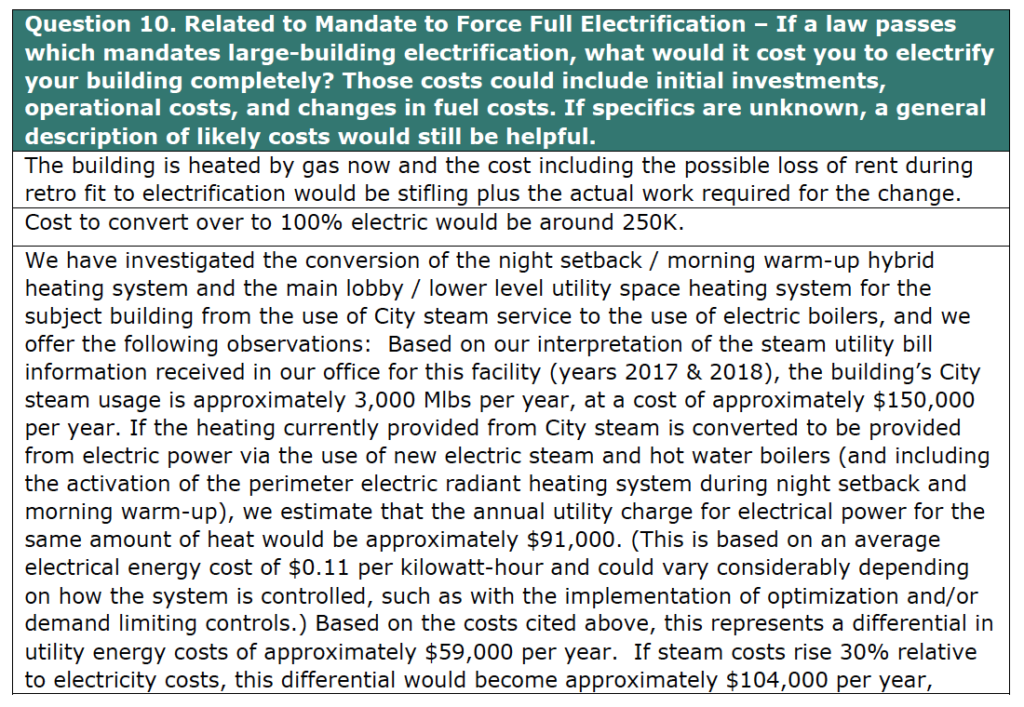

On our recent survey of owners of large buildings in Colorado, 27% of respondents indicated that their properties could not meet the draft bill’s performance targets with investments that result in a positive return, and 19% expressed uncertainty.

Several stated that the initial costs would be too great, and one commented that occupancy levels have been low enough recently (that is, during the pandemic) that spare financing is scarce. Others responded that they have already adopted all the strategies they could with positive present values. The way the draft benchmarking bill is written, these owners would not be credited for those investments. One claimed that “After already raising our Energy Star rating from 61 to 71 we have run out of projects to consider unless we completely re-engineer the entire mechanical plant. Past ROI analysis show an unrealistically long time frame no owner would accept [sic],” and also that making a large investment now or within the next decade would be unreasonable due to widespread vacancies beginning during the COVID-19 pandemic.

Though 54% of respondents indicated that their buildings could achieve the targets, several of their comments speak to the challenges they would face. One respondent expressed optimism about reaching compliance by making positive investments, but worried that the payback periods of those investments may be effectively unreasonable. Two others specifically noted the challenges brought about by COVID-19. One wrote that “COVID has hit our building hard. We are focused on lowering [operating expenses] and leasing up our vacancies. We do not have the capital to support this type of mandate.” The other wrote that compliance would be possible, but that it “would cost a substantial amount to get going and complete the projects, buildings not in current position to do, especially with unknown of future tenants [sic].”

Using Energy Star Scores as Performance Requirements Creates an Inconsistent Standard Over Time

The foremost performance standards detailed in the draft bill are to be measured in Energy Star scores—Energy Star is a national program which ranks and scores America’s large buildings by their energy-efficiency percentiles within their peer groups.[v] Though requiring a minimum score of Colorado’s buildings would meaningfully recognize the achievements of those buildings which already operate to high standards of energy-efficiency, and most respondents to the CSI/CREA/Building Jobs 4 Colorado survey indicated that attaining the draft bill’s Energy Star 75 minimum is the easiest path to compliance, it is practically impossible for all large buildings in the state to maintain high scores.

Because buildings, especially new ones, are tending to become more energy efficient as technology advances, high Energy Star scores are becoming increasingly difficult to maintain. This specific change to Energy Star scores will occur sometime this year as updates are made based on 2019 national building survey results, rather than 2012 survey results.

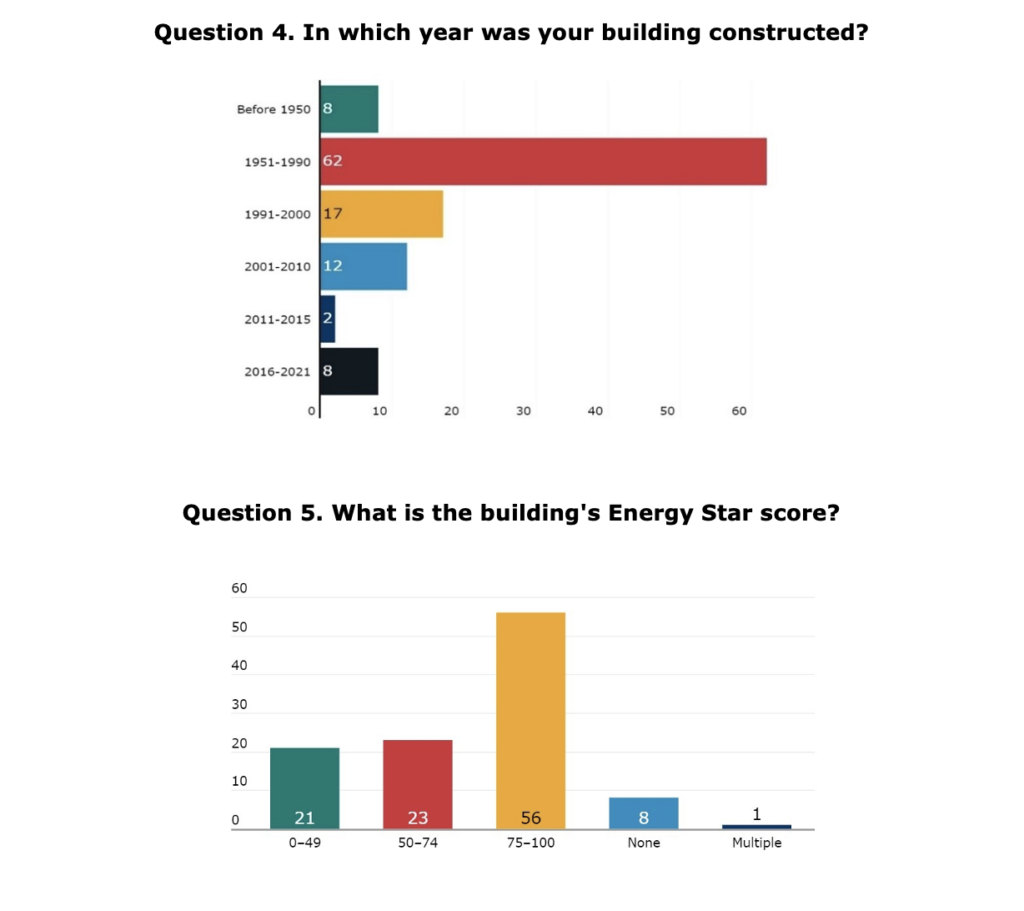

A building with a compliant score in one period may reasonably operate to the same standard of energy-efficiency in the next and still fall out of favor because of the relative ease newer buildings have of operating cleanly. In this regard, an Energy Star score requirement especially burdens older buildings which already would be more difficult, and will become even more difficult still over the next several years, to coax into compliance.

As one survey respondent commented, “it will become more difficult to maintain [a compliant score] as the Energy Star standards become more stringent over time and may become costly enough to move the ROI negatively.” Another noted that “We could continue to hit [Energy Star scores in the] 80's with changing nothing, but if they continue to make Energy Star harder, we'll have put a lot of dollars in which is not feasible [sic].” Furthermore, other states are also seeking to make their buildings more efficient; since Energy Star ratings are distributed on the basis of a national percentile, how can some buildings possibly comply, especially in the long run?

2. Commercial Building Electrification Poses Significant Costs and Limited Emissions Benefits in the Near Term

Though its prospects improve as years progress after 2030, forced building electrification at present would impose significant equipment and operational costs upon businesses and public utilities yet would not significantly reduce greenhouse-gas emissions.

Efforts to Force Electrification Too Quickly Will Not Immediately Reduce Emissions

The draft benchmarking and performance standard bill does not prescribe any manner by which the buildings it concerns must reduce their energy intensity, but since electric equipment, particularly electric heat pumps, can be less energy-intensive, some building owners may see electrification (the transfer of a building’s power generation from on-site fossil-fuel equipment to an off-site electric utility) as an option for pursuing compliance. The Colorado GHG Pollution Reduction Roadmap stresses that building electrification will be a persistent object of state policy, too; according to the Roadmap, “very high levels of electrification [will be] needed to achieve the 2050 [emissions] goals.”

Building electrification is already becoming more popular as technology advances and electric grids become cleaner, but the Roadmap's recommendations are designed to accelerate the trend in pursuit of the state’s long-term reduction goals. If building owners are artificially encouraged to electrify their properties before the technology exists to make it holistically desirable, they may install equipment before their existing equipment ends their life cycles or which will swiftly become outdated as innovation progresses.

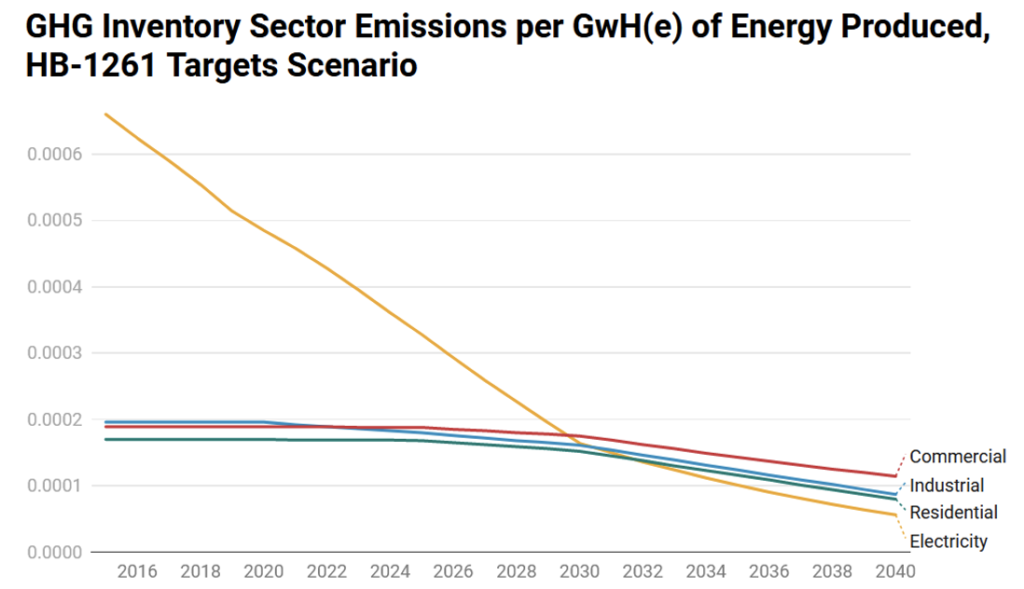

In 2019, emissions generated by electric utilities produced between 263% and 303% more emissions per equivalent unit of energy than each of the three building sectors (residential, commercial, and industrial).[vi] Those numbers shrink to 0% and turn negative after 2030 given the policy scenarios in the Roadmap, but the differences are not very big for several more years.

Full electrification can reduce emissions by 29.6%, 50.9%, and 35.6% in the residential, commercial, and industrial building sectors, respectively, by 2040, under Roadmap policy projections. The true cost of achieving that is unclear, however, and if Colorado’s built environment were to fully-electrify sooner, in 2021, the state’s total emissions would be about 39 MMT CO2e—almost 35%—higher than they’re expected to be otherwise (the actual effect would be somewhat less severe than that, since electric equipment is more end-use energy-efficient than fossil-fuel equipment). Accelerating electrification to that degree would be disastrous to the pursuit of Colorado’s economy-wide emissions targets.

In the Short Term, Colorado’s Electrical Grid Can Not Handle a Rapid Influx of Electricity Demand without Causing Rates to Increase Dramatically

Though a similar report does not exist regarding the conversion of commercial buildings, recent analysis by Xcel Energy, Colorado’s largest electric utility, shows the full electrification of the residential sector would cost $7,000 per home today—over 9% of the state’s median household income. That cost drops significantly through next decade to a projected $2,500 per home by 2030.[vii]

This high short-term cost of swift electrification would result from the extensive upgrades and expansions that the electric grid would have to undergo in order to support it. Electrification moves peak electricity demand from summer to winter, which would force utilities to either overhaul their operations or endure regular blackouts. According to the same report by Xcel, "with aggressive electrification, the electric system could shift to a winter peak in the 2030s, possibly earlier, and even before then, the electric system could require more than 4,000 megawatts of new capacity to cover the increased demand—more than a 50% increase in the system’s capacity."

The investment required to equip the grid to handle all the new demand would, naturally, cause customers’ electric rates to skyrocket. If residential electrification becomes mandatory for new builds, Xcel Energy's natural gas customers would pay $66 (about 6%) more for the service, annually, by 2030. If electrification is mandated for all, including existing, residences, those same annual prices would increase by $930vii—almost 88%. Though additional research by Xcel has not been publicized, it follows that large-scale electrification of new and existing commercial buildings would increase these costs as well. This would be very burdensome to the people of Colorado, especially those most-harmed by the ongoing recession.

Electric Retrofitting May Not Be Feasible, or May Be Too Costly, for Some Buildings

Building electrification will become easier and less expensive over time, but, for now, it remains prohibitively expensive for some buildings and completely impossible for others. Some building uses are technologically easier to electrify than others (the requisite technology for agricultural and industrial electrification is many years off, for example), and cold-weather electric heating technology is still relatively infantile. According to Xcel, “the value proposition of electrifying...improves starting in the mid-2020s as commercially available electric technologies for space and water heating and other appliances become more efficient and as Xcel Energy’s electric system becomes less carbon intensive."

Existing technology is not wholly sufficient to ensure the enduring efficacy of high-tech electrical equipment, so forced electrification imposes a high risk of equipment obsolescence upon compliant buildings. Operators unaccustomed to electric systems, additionally, will have to undergo potentially years of re-training in order to learn how to operate them efficiently. If building owners are artificially encouraged to electrify their properties before the technology exists to make it holistically desirable, they may install equipment which will swiftly become less initially expensive as innovation progresses.

3. The Timing of the Draft Bill’s Performance Standards Is Dubious and the Administrative Costs are Unknown

Buildings are getting cleaner, innovation is advancing, and the economical appeal of electrification is growing already—how large a sum is worth paying to accelerate those trends, and is now the right time to try?

The Costs to the State and to Taxpayers of Such an Ambitious Program are Unclear

The launching and continuity of the draft bill’s benchmarking and reporting program depend upon several daunting responsibilities that Colorado’s government stands to undertake. The state will be responsible for collecting and synthesizing an immense amount of data about Colorado’s built environment, creating and maintaining the reporting channels for buildings, interpreting countless reams of submitted data, enforcing compliance, auditing troublemakers, drafting new performance rules, and issuing and collecting fines for noncompliance; these together will require extensive labor and administration which taxpayers will have to fund. Energize Denver, a benchmarking program limited to Denver’s city limits and which does not enforce performance standards, cost $1.3m of public money in 2020;[viii] a statewide requirement which includes performance standards stands to cost much more than this.

It is important that regulators understand and consider the costs as they decide whether and how to implement legislation. No fiscal cost estimate of the draft bill has yet been developed, and legislators should be wary of saddling taxpayers with indefinite costs.

Building Benchmarking Alone Could Be Beneficial to the State Government and the Private Sector Before Regulators Set Performance Standards

Because of the uncertainty of the costs of draft-bill compliance and the potentially-awkward timing of reduction mandates considering the short-term outlooks for electrification and demand-side management, a reasonable approach may be to gather information now through benchmarking, without the pressure of enforceable requirements, and delay imposing performance standards until the government understands Colorado’s building stock better and the electrical grid has had enough time to support an aggressive shift to electrification.

A reporting requirement alone, in addition to providing regulators valuable information, can effectively heighten the environmental performances of buildings by forcing operators to gain thorough understandings of their buildings’ energy-use intensities and, thus, highlighting some ways by which they might reduce costly waste. In Denver, since the launch of Energize Denver’s benchmarking requirement, all building types except municipal and distribution (already the lowest-intensity category) have reduced their average energy-use intensity readings[ix]—owners who can definitively identify areas of opportunity for energy savings are easily motivated to act upon them.

Conclusion

Without comprehensive data collected through reporting or some other means, understanding the aggregate economic impacts and net costs of this draft benchmarking bill is impossible—if businesses and ordinary taxpayers are to trust that such a program as this will not affect devastating unintended consequences upon some actors within the private sector, much more information ought to be presented. Once enough is understood about Colorado’s building sectors to begin developing reasonable performance standards, the guiding regulatory effort should be to prioritize targeting promising and cost-effective reductions and to avoid unintentionally penalizing buildings for outcomes out of their owners’ controls or the successes of others. Under the auspices of a prudent approach, buildings in Colorado can reduce their environmental impacts without overspending, and some may even benefit financially from it.

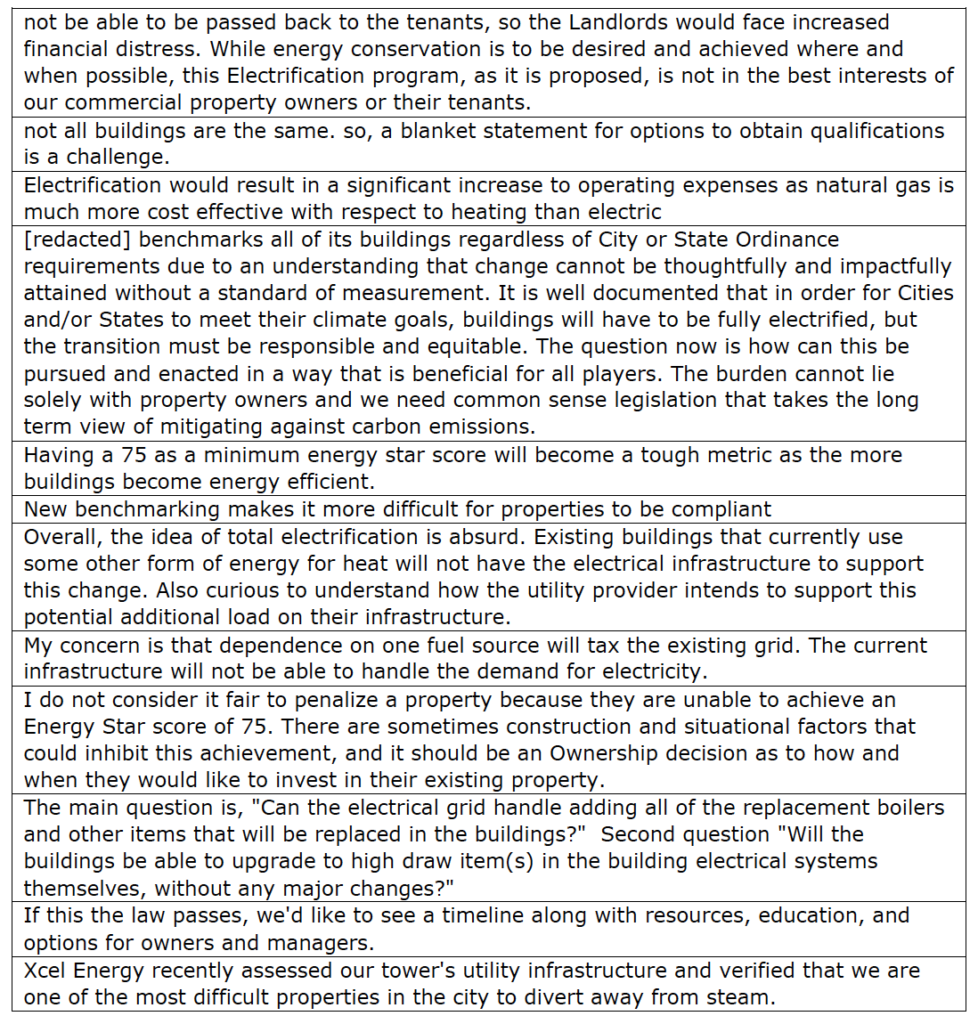

Appendix A – Survey Results

A Survey of Commercial Building Owners and Operators Highlights Many of the Key Outstanding Questions and Concerns About How Mandates Will Impact their Businesses

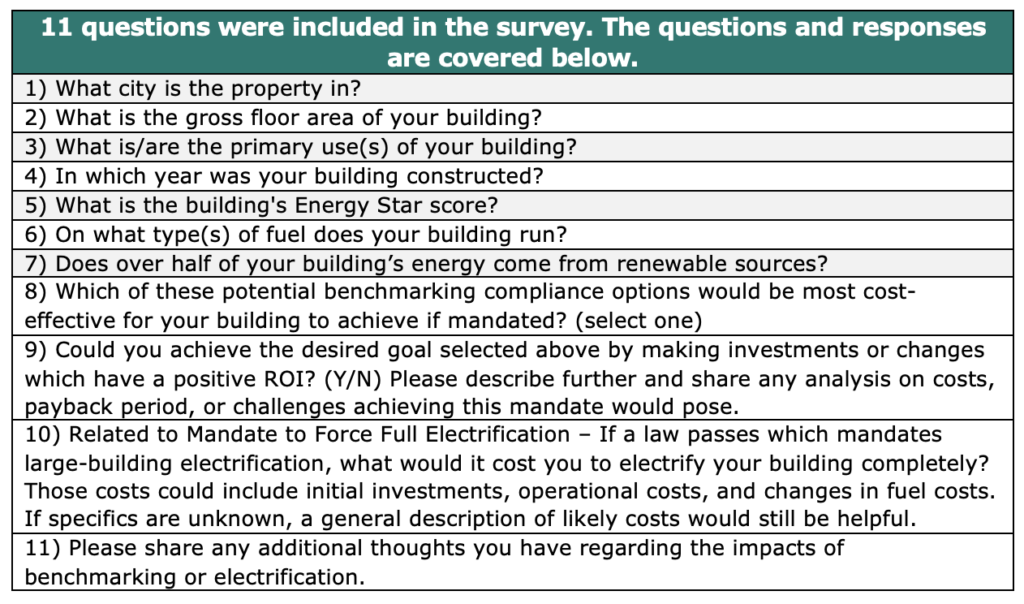

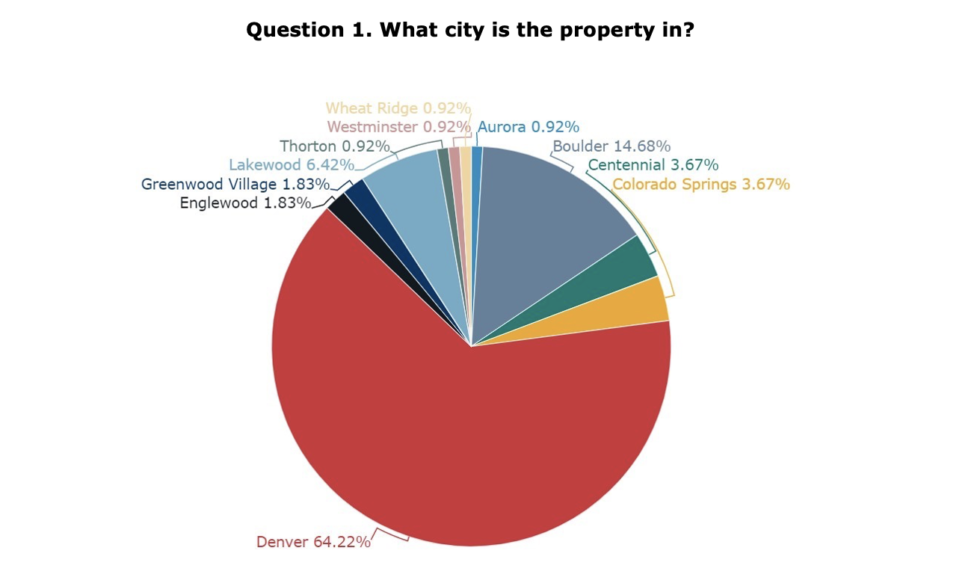

During the week of February 22th through February 26th, in coordination with Colorado Real Estate Alliance (CREA) and Building Jobs 4 Colorado, CSI conducted a survey to collect responses from large commercial building owners to better inform the understanding of potential impacts related to establishing emission and energy reduction mandates for covered properties.

Energy-efficiency and emissions reductions are front-of-mind goals for any responsible building owner, both as good business decisions and as actions of responsible environmental stewardship. Though an effort to enforce the pursuit of these goals seems well-intentioned, closer evaluation finds that it can cause unpredictable and often devastating impacts. As there lacks much publicly available aggregate data about these issues, this survey was intended to gather that sort of information in a localized and qualitative, but hopefully informative, manner.

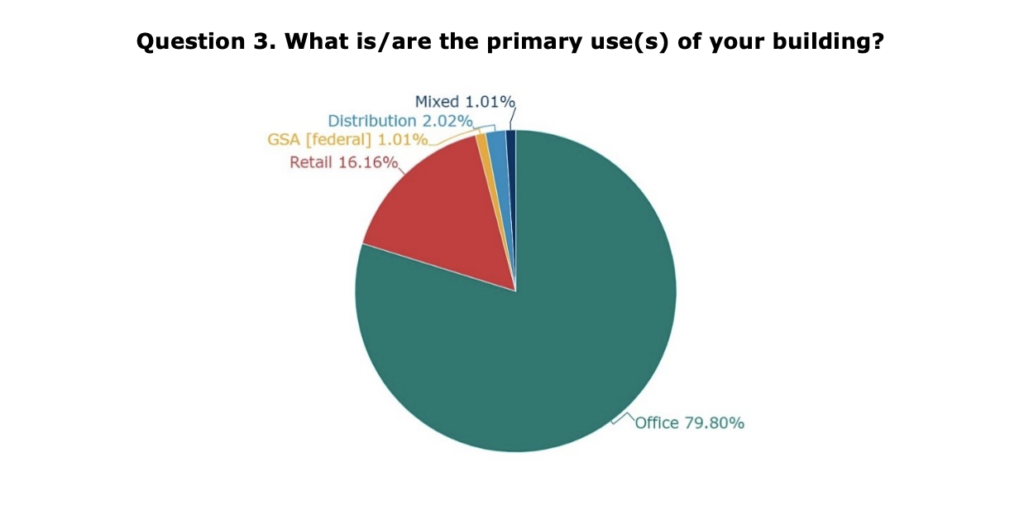

The results displayed of questions 1 through 8 capture all survey respondents, and the featured responses to questions 9 through 11 were selected for completeness and insight from their respective pools of 108. All comments directly from survey respondents are presented unedited.

End Notes

[i] https://energyoffice.colorado.gov/climate-energy/ghg-pollution-reduction-roadmap

[ii] Emissions data from Colorado’s GHG Inventory and E3; building counts by sector from the U.S. Census Bureau

[iii] https://apps.douglas.co.us/assessor/advanced-search/

[iv] https://www.mckinsey.com/~/media/mckinsey/dotcom/client_service/epng/pdfs/unlocking%20energy%20efficiency/us_energy_efficiency_exc_summary.ashx

[v] https://www.energystar.gov/

[vi] Colorado emissions historical data and projections by E3, used to construct the Roadmap’s policy scenarios

[vii] https://www.xcelenergy.com/staticfiles/xe-responsive/Environment/Carbon/Xcel%20Energy%20Transitioning%20Natural%20Gas%20for%20a%20Low-carbon%20Future_Nov%202020.pdf

[viii] https://www.denvergov.org/Government/Departments/Department-of-Finance/Our-Divisions/Budget-Management-Office-BMO/City-Budget

[ix] https://www.denvergov.org/content/dam/denvergov/Portals/779/documents/commercial-energy/2019EnergizeDenverAnnualReport.pdf