Summary and Key Findings

This November, Scottsdale residents will decide whether to “enact a transaction privilege and use tax”[i] at a rate of 0.15% to fund city parks and preserves. Under current law, an existing 0.20% sales tax expires, and the city sales tax rate falls to 1.55%, at midnight on June 30, 2025. If approved by voters, the sales tax rate increases to 1.70% from and after July 1, 2025 (expiring in thirty years, in 2055).

City Transaction Privilege Taxes (sales tax or TPT) are paid by all city businesses on any transaction occurring inside city limits (or attributable to city limits under the state’s marketplace and nexus rules). They provide for the general operations and maintenance of state and local government. Of approximately $18 billion in statewide annual collections, approximately two-thirds is attributable to statewide rates; the remaining one-third are attributable to local (county and city) taxes. In 2023, the City of Scottsdale collected $341.8 million in sales taxes at the current (1.75%) rate.[ii]

Initially, the city described Prop 490 as “repeal(ing) and replace(ing)”[iii] the expiring 0.20% tax; following litigation by the Goldwater Institute, the City amended the language in an emergency meeting.[iv] The information pamphlet now proposes simply, “to enact a tax”.

According to a Common Sense Institute (CSI) analysis of the proposed language, Scottsdale Proposition 490 would:

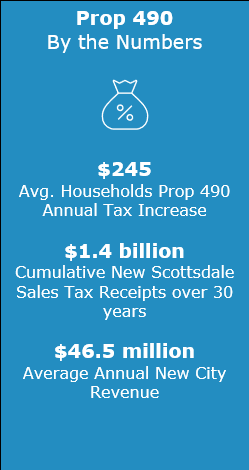

- Increase city sales taxes by a cumulative $1.4 billion over the next thirty years, assuming an average annual sales tax revenue growth rate of 3%.

- Increase city revenue by an average of about $46 million/year, or roughly 1% of its current budget. This new revenue would be earmarked for the maintenance and improvement of parks and nature preserves.

- On a per household basis, the new tax burden created by the Prop 490 taxes averages about $245/year.

Because the total tax increase is relatively small, confined to the City of Scottsdale, and nearly fully offset by increased local spending, its aggregate economic impacts may be de minimis. However, to the extent that the proposed new spending could be accommodated by the existing City budget and without the new tax, then the tax represents a net decrease in city income and employment relative to current law.

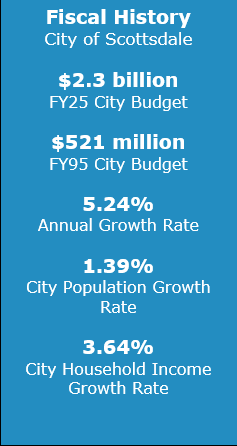

For context, since 1995 and enactment of the expiring 0.20% special sales tax for parks, Scottsdale’s budget has grown at an average annual rate of more than 5.2% to $2.3 billion/year in budgeted spending.

A Fiscal History of the Scottsdale City Budget

The City of Scottsdale has a total budget of $2.3 billion.[v] Of that amount, $79.2 million is appropriated to Community Services, which includes the city’s parks and recreation services. $1.07 billion is allocated for Capital Improvements – the largest single component of city outlays; this includes acquiring any new land, buildings, or other permanent structures and improvements to existing[KS7] assets. To support its budgeted spending plan, the city relies primarily (43%) on unexpended resources from its existing Capital Improvement Plan (monies previously allocated for capital projects but intended to be spent this year). Remaining ongoing sources are a combination of: other revenues, e.g. fees and state-shared revenue (30%); sales taxes (12%); and property taxes (3%). One-time sources and fund transfers account for the balance.

In 1995, the city had a total budget of $521.4 million.[vi] Of that amount, $17.5 million was appropriated for Community Services and $321.2 million for Capital Improvements. The current 0.20% special sales tax for parks was first effective that year. On an inflation adjusted basis, the 1995 City budget would be the equivalent of $1.07 billion today [CB8] [CB9] – including $36 million for Community Services and $661.7 million for Capital Improvements.[vii]

Assuming no other changes to the city budget, under current law, the expiration of the special sales tax for parks next year would reduce total revenues from approximately $2,295 million to $2,256 million. Again, assuming no other changes, the Community Services operating budget would fall to approximately $64.0 million, and the Capital Improvements budget to $1.05 billion.[1]

Since 1995, the city budget has grown at an average annual rate of 5.24% - faster than both the sum of population and inflation growth and the sum of population and household income growth. A useful metric to hold a governing agency’s service level constant over time is to suppose its budget had grown at the rate of population growth and inflation over the reference period. Faster growth can be assumed to have resulted in increased service levels (per-person); slower in reduced levels. Had the Scottsdale City budget grown at the rate of population and inflation over the past thirty years, the budget today would be approximately $1.4 billion. The actual city budget is $2.3 billion, or $925 million (67%) larger than this constant-service-level counterfactual. The expiration of the park sales tax would only reduce this surplus to $886 million.

Proposition 490 Summary

Scottsdale’s Proposition 490 would increase the City sales tax rate next year by 0.15% (to 1.70%), from a baseline planned rate of 1.55% under current law. For context, the City sales tax rate today is 1.75% and the average combined TPT rate for city taxpayers is 8.05%.

Based on statewide reporting by the Department of Revenue, Common Sense Institute estimates that receipts from the current 0.20% sales tax for parks were $39 million in 2023 (the most recent reporting year).[viii] The analysis that follows assumes an average annual city sales tax revenue growth rate of 3%:

- If the existing tax is allowed to expire as planned under current law, Scottsdale City sales tax revenue would decline by an estimated $31 million in the 2025-2026 fiscal year compared to the prior year. Those declines may be partially or wholly offset by increases in other sources.

- If the new Prop 490 tax is approved by voters, TPT revenue would increase by $200,000 in the 2025-2026 fiscal year compared to the prior year. However, revenue would increase by $31 million relative to current law.

- Over the 30-year life of the proposed new tax, if enacted CSI estimates it will generate a cumulative $1.4-$1.5 billion in new revenue.

- The City estimates cumulative revenue collections of $1.15 billion over thirty years.[ix] CSI regards this estimate as conservative.

The City in its official information and description for voters originally described the plan as “replace(ing) and reduce(ing)” an expiring tax from the current 0.20% tax rate to 0.15%, and for thirty years. This likely would have led to voter confusion. In general, it is most accurate and least confusing for voters when discussing policy changes to frame the counterfactual as current policy; often the change in outcomes over time can serve as a proxy to estimate the impact of a policy change, but the ultimate goal should be to inform the voter of their two alternatives under the proposed change (not some hypothetical and purely coincidental change in year-over-year conditions).

In this case, Proposition 490 is unequivocally an increase in tax rates relative to current law.

On August 22nd – following a Court of Appeals ruling confirming the confusing and misleading nature of the original proposition – the City adopted new language which reads simply: “A city code amendment to enact a transaction privilege and use tax rate”.

Economic Implications & Proposed Improvements

To assess the economic impacts of the proposed citywide sales tax increase, CSI utilized the Regional Economic Models, Inc. Tax-PI (REMI) dynamic economic modeling program. Because the proposed tax increase is relatively small and limited only to the jurisdictional boundaries of the city of Scottsdale, its implications on the broader state’s economy are likely limited. Further, nearly all expected receipts are earmarked for direct local spending; this will approximately fully offset the negative implications of the sales tax increase.

Based on a REMI simulation, and after accounting for offsetting impacts from increased local spending, CSI expects that the city sales tax increase will reduce statewide Gross Domestic Product by a cumulative $27 million over the next twenty years. For context, Arizona GDP is approximately $411 billion/year. Employment changes are unlikely to be statistically different than zero, but the tax will likely reduce private and increase public employment within the City of Scottsdale and compared to a baseline where it can expire as scheduled.

The local nature of the tax increase means detrimental impacts will be concentrated and slightly larger than statewide impacts in the City of Scottsdale. On the other hand, there may be a slight increase in economic activity in the jurisdictions bordering Scottsdale, due to shifting in response to the change in costs.

The average Scottsdale taxpaying household would be responsible for approximately $245/year [CB12] [GF13] in increased tax liability, or a loss of between $30 and $70 million/year in disposable personal income. These losses would be offset by both increased income for direct beneficiaries of the increased spending of tax revenues, and the passage of a portion of the tax liability to out-of-city residents when they shop at taxable Scottsdale business locations.

If in the absence of the tax extension the city government would find other, existing fund sources to maintain the planned park and preserve spending, then the tax is more economically damaging than contemplated here (this analysis assumes the tax increase is offset by new local spending on roughly a dollar-for-dollar basis). [KB14] [GF15] [KB16] For example, if none of the proposed spending is truly “net new”, Scottsdale GDP would decline by approximately $50 million/year and the city would lose up to 500 private-sector jobs. For context, the projected revenue under the tax increase is about 1% of Scottsdale’s total budget in FY25.

[1] This analysis assumes 51% of the existing special tax is reserved for Capital Improvements funding, and 39% for Community Services.