As the Colorado General Assembly nears completion of the state budget there is little doubt that the decisions they make will impact Colorado’s economy for years to come. Known by insiders as the “long bill,” the state budget has passed the State House and is currently being debated by the State Senate.

FY23 Budget Highlights and CSI Research

- Total state spending is expected to increase by $1.35 billion, or 3.7%, in the FY23 budget. Historic state tax revenue allowed the legislature to increase General Fund spending by $1.55 billion, or 12.7%, while cash funds and federal funds decreased by $360 million.

- The FY23 total operating budget is set to be $7.5 billion larger than the FY19 budget. This is a 25% increase from the budget passed prior to the pandemic; General Fund spending is set to be $2.3 billion, or 20%, higher.

- Because projected revenue growth will be in excess of the TABOR expenditure growth limits, TABOR refunds are expected to be $2 billion in the current FY22 budget and $1.56 billion in the FY23 budget.

- 2 out of every 3 new dollars in General Fund spending, or $1.02 billion, will go to the Colorado Department of Health Care Policy and Financing, due to the ending of lower state Medicaid match rates.

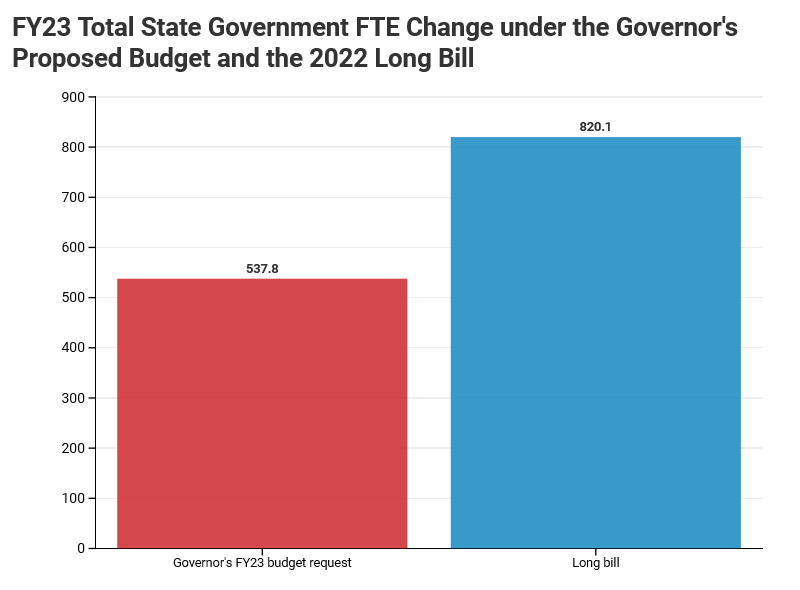

- The FY23 budget raises state-government FTE (full-time equivalent) employment by 1.3%—a 52% increase from the annual growth amount originally requested by the governor.

- Though the FY23 budget includes funding set aside for the passage of bills related to two key areas studied by CSI, no definitive decisions have been made to address two of the state’s two largest fund deficits: the Unemployment Insurance Trust Fund (UITF) and the Public Employees’ Retirement Association (PERA).

- The $900 million that the long bill sets aside for flexible one-time spending on legislative priorities is less than the $1.1 billion proposed to be transferred to the UITF by SB22-066.

- While the budget puts money aside for the current year PERA payment required by SB18-200, it does not explicitly state how much, if any, additional funds would be directed towards making up for the missed PERA payment in 2020, as dictated by the yet-to-be-debated HB22-1029.

- The FY23 budget will make historic levels of spending related to housing, made possible by federal COVID-19 stimulus. However, important questions remain about the extent to which it will have meaningful impact on housing supply.

The following sections offer additional context and findings, supported by CSI research, related to the FY23 budget as it’s described by the Joint Budget Committee’s Long Bill Narrative.

[i]

Budget Then & Now

In December, CSI released “The Colorado Budget Then and Now.” The annual report provides a comparison of state budgets over the last twenty years and provides a summary overview of state spending across different state funds and agencies. The trends identified in the report reflect the shifting priorities brought on as a direct result of the laws and budgets passed each legislative session. Health care spending’s share of the state budget, for example, has grown by over 10% in the last decade, and in FY23, health care will receive 66% of the total increase in general fund appropriations despite accounting for only 25% of the general fund in FY22.

Unemployment Insurance Trust Fund

Compared to a 2020 baseline, Colorado employers face $4.4 billion in additional state and federal unemployment insurance payroll taxes between 2023 and 2027. These taxes, alongside record inflation and many new regulatory costs, will impact businesses' finances tremendously. Although replenishing the unemployment insurance system is necessary for the sake of Colorado’s economic future, the effort it will take to do so will slow the state’s post-pandemic recovery.

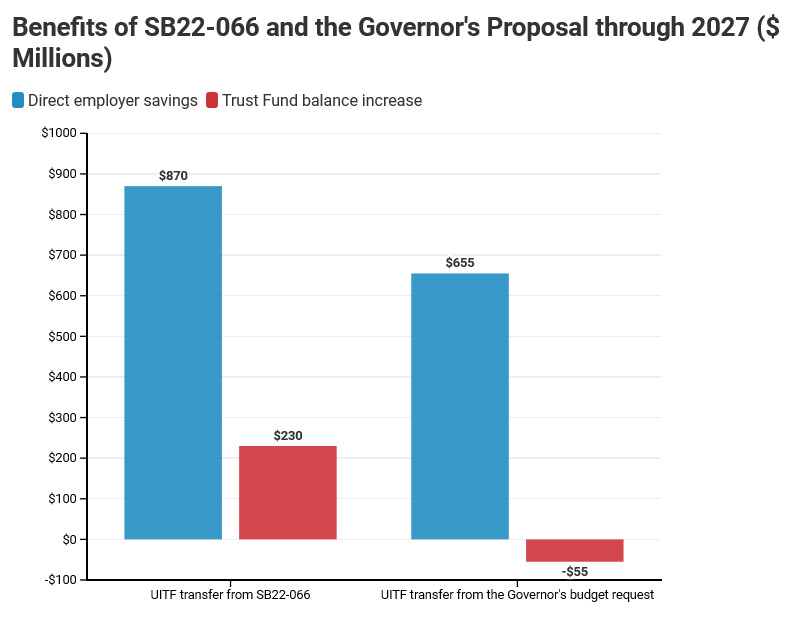

Both Governor Polis and several legislators have proposed transferring large amounts of money to the Unemployment Insurance Trust Fund (UITF) to alleviate employers' cost burdens over the next several years—the governor included a $600 million allocation in his FY23 budget request, and SB22-066 proposes transferring $1.1 billion to the fund in July. These policies would save Colorado employers $655 million and $870 million, respectively.

Despite these proposals, no supplementary unemployment insurance funding is included in the current long bill. Any amount to be transferred from the general fund to the UITF will come from among the $900 million set aside in the budget for one-time legislative spending. This reserve is insufficient to provide the allocation requested by SB22-066.

Colorado Public Employees’ Retirement Association (PERA)

The findings of recent CSI research show just how unbalanced the PERA system has become. The combined contributions from both taxpayers and PERA employees has grown to be equivalent to more than 30% of employee pay, and more than 50% of annual contributions go towards paying off the $31 billion in unfunded liabilities. 2018 reforms that increased the taxpayer’s contribution rate were supposed to reduce PERA’s unfunded liability, but instead, the problem has grown worse, in part because the legislature chose to forego its required $225 million payment in 2020.

Early in the current session, HB22-1029 was introduced to allocate $303.57 million directly to PERA, to make up for the missed payment in 2020 plus interest. Though investment returns have remained above the needed target rate of return, the PERA unfunded liability has grown, partially due to the missed payment and partially because of further revisions to actuarial assumptions that increased the costs.

Should the PERA funding bill pass following the budget, it will help maintain the retirement funds on their desired 30-year window to eliminate the $31 billion unfunded liability.

State Government Employment

The governor’s FY23 budget request proposes to increase the Colorado state government’s total workforce by .87% (537.8). The long bill, conversely, appropriates a 1.32% (820.1) addition to the total workforce.

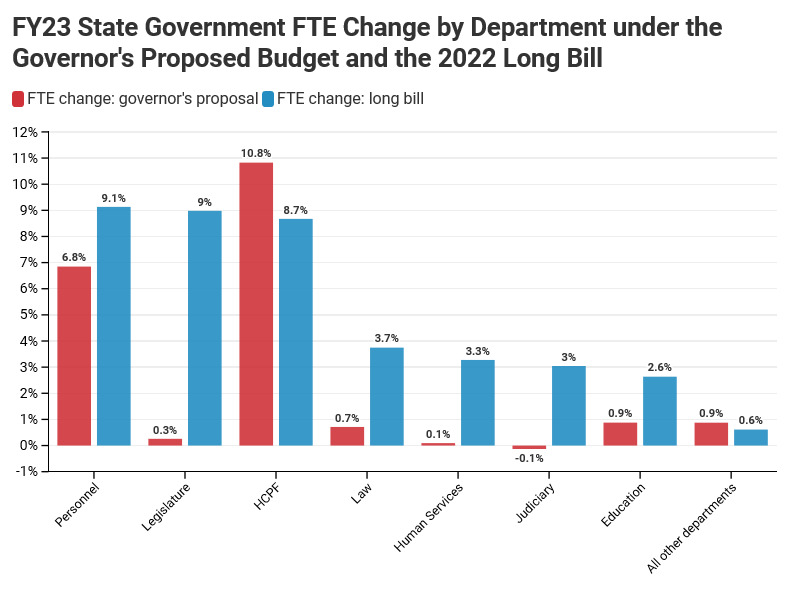

The growth of the state government’s full-time equivalent employment (FTE) follows a clear historic trend: over the last 10 budgets, projected private-sector employment growth (23.3%) exceeds the total government FTE increase under both the governor’s FY23 request and the long bill. Over that same period, however, several state departments have grown significantly faster or slower—under the long bill, six departments, which together account for over half of the budget’s total FTE growth, will receive FTE increases above 6% in FY23.

The Department of Health Care Policy and Financing, which will receive the largest appropriations increase by far in FY23, is appropriated a 10.8% FTE increase under the governor's request and an 8.7% FTE increase under the long bill. Department FTE trends can help predict the state budget’s long-term monetary commitments.

Housing

One of the most significant issues facing Colorado is affordable housing. Housing prices are surging, inventory is declining, and affordability is decreasing. According to a recent CSI analysis, the median price of single-family homes increased by 19% in the 12 months prior to January 2022 and townhouse/condos increased by 17%. Perhaps even more astoundingly, according to the Case-Shiller Home Price Index, prices of starter homes have increased by 83.3% since 2015.

Though the budget allocates a historic level of appropriations towards housing, totaling more than $400 million, cursory reports that accompanied the completion of a report by the Affordable Housing Transformational Task Force indicated that the expectation is that this new spending would create or retain 15,000 housing units. That same report estimates a current housing deficit of 225,000 housing units and the need to build more than 100,000 more in the next two years to accommodate population growth.[ii] This estimate is similar to, though higher than, the estimated level of the housing shortage reported in CSI’s 2021 report.

[i] https://leg.colorado.gov/sites/default/files/22lbnarrative.pdf

[ii] https://leg.colorado.gov/sites/default/files/affordable_housing_report_final_0.pdf