Key Findings

- Housing affordability in Colorado is near an all-time low, driven in-part by a housing supply deficit of more than 100,000 units. HB23-1115 proposes to repeal the state prohibition on local governments enacting rent control. Rent control is a policy concept that has been debated for decades, and now has mounting evidence trailing it that shows large unintended consequences.

- Evaluations of cities that have enacted rent control prove it to be disruptive to markets and inadequate for resolving housing affordability broadly at best. At worst, it severely limits new housing supply, limits mobility and leads to increased rents in the long run.

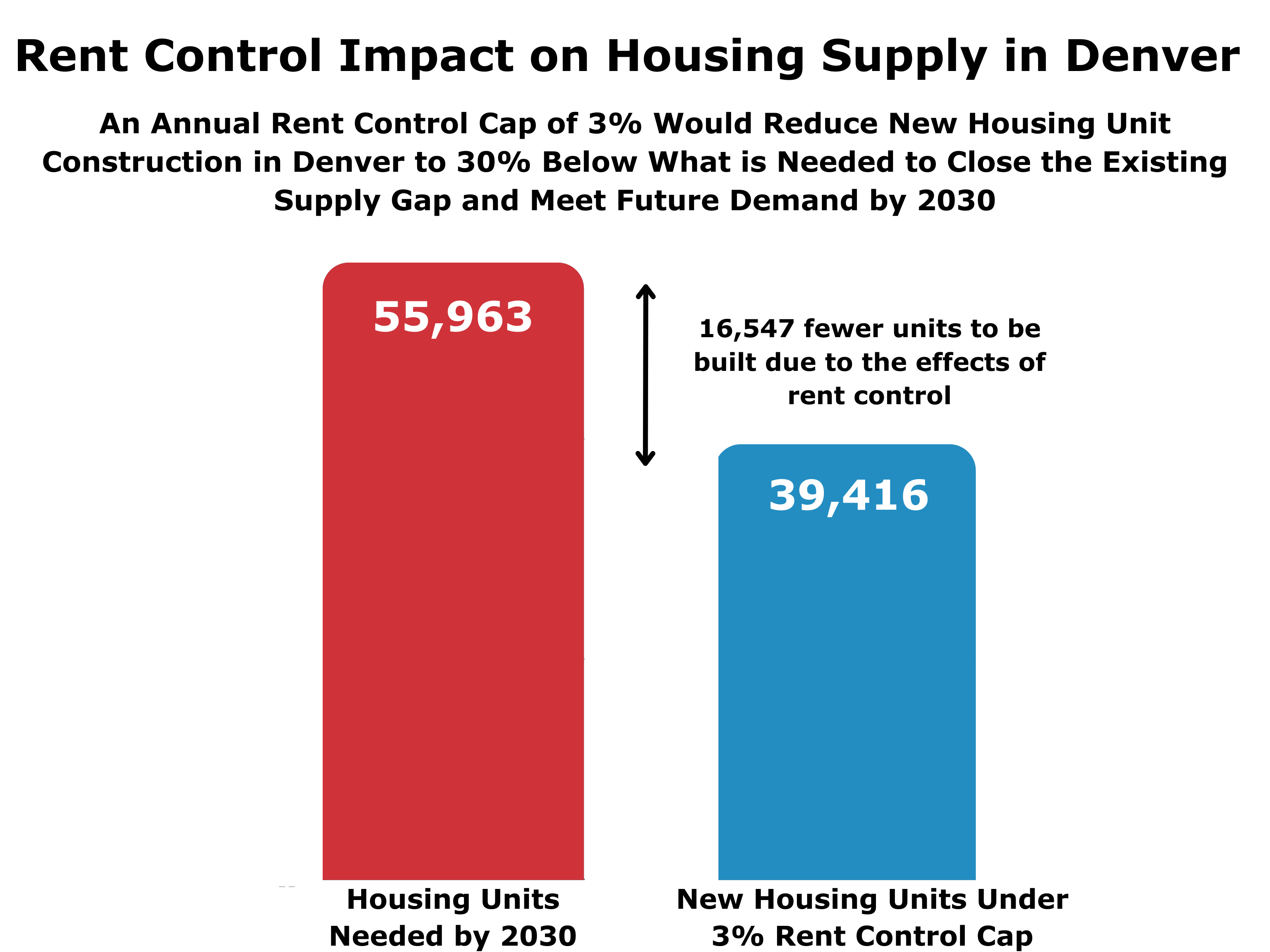

- If rent control were to pass in Denver, by 2030 the city would stand to lose 16,547 housing units at a 3% rent cap or 9,348 units at a 7% rent cap. This would hamper the ability of the city to create the needed nearly 56,000 housing units by 2030, to fill the existing supply gap and meet the demand of anticipated future residents.

- Not only does rent control impact housing supply, but it also decreases the value of both regulated and nonregulated properties. NAA estimates that under a 7% annual rent increase cap, Denver’s apartment buildings alone would cumulatively lose an estimated $462.2 million in property value, amounting to approximately $2.6 million reduced property tax revenue.

About HB23-1115

The issue of housing affordability and supply is a top concern for many Coloradans who have experienced rising rent costs coupled with abnormally high inflation. Hoping to address this, lawmakers have put forth HB23-1115, which, as introduced, would repeal provisions prohibiting local governments from enacting rent control on private residential property or on private housing units.

[i] During the 2022 legislative session, HB22-1287 included a provision to allow rent control of third-party–owned manufactured home parks. CSI issued an analysis of the provision and, after a veto threat from Governor Jared Polis, this provision was removed prior to passage.

HB23-1115 has already been amended to include a rent cap floor, stating that landlords could still raise rents at least 3% plus inflation annually, and a stipulation that no rent control regulations be applied to any building constructed in the last 15 years.

[ii]

Unintended Consequences of Rent Control

Rent control is often discussed as a policy solution to housing unaffordability because it is structured to provide below-market rents to those who would perhaps otherwise be unable to afford their rental unit. Reports cited below have shown, however, that rent control policies come with a slew of costly, unintended consequences for both tenants and the cities in which they’re enacted.

Effect on Housing Supply

The most notable of these unintended consequences is the negative impact that rent-control policies have on both the current apartment housing supply stock and the future supply of new buildings.

Evidence of Impacts to Housing Supply from Existing Literature:

- A study on rent control in San Francisco found (Diamond, McQuade, Qian, 2018):[iii]

- Rent controlled buildings were 8% more likely to convert to condos or other housing forms than non-controlled buildings.

- Landlords regulated by rent control reduce rental housing supplies by 15% by selling units to occupants and redeveloping buildings.

- Further evidence from a study on New York City found that the city lost 130,000 units of rent-controlled housing because of co-op and condo conversions, expiring tax breaks, and other factors since 1993.[iv]

- Rent control regulations also de-incentivize new construction as some builders opt to instead invest in places without these regulations in place. A study in New Jersey found that rent-controlled cities have around 25% fewer rental units than do cities without rent control.[v]

- The impacts of rent control regulations being implemented by a local government are not confined to the city limits. A city’s choice to enact rent control impacts neighboring localities through decreased supply, as witnessed in New Jersey. Apartments which would otherwise be on the market for those looking to rent are removed from the rental housing supply stock because of the policies, creating further housing supply issues and making it harder for Colorado residents to move to, or live in, their desired area.

Using previous CSI estimates found in the July 2022 Colorado Quarterly Housing report,[vi] CSI estimate that the city of Denver will need 55,963 additional housing units to close the current housing deficit and meet new demand through 2030. Of these, 43,092 are estimated to be multi-family. The total level of permits in 2022 shows that the city has the potential to hit this target, but the introduction of rent-control regulations would derail this progress and severely challenge the ability of the city to achieve it.

Using an impact model developed by the National Apartment Association (NAA) and additional modeling done by CSI, the above figure shows the potential impact a 3% annual rent cap would have on new apartment construction in Denver.[vii] This modeling does not capture the impact of the recent amendment to HB23-1115 which prohibits rent control of units younger than 15 years of age. Though this change would have some effect on mitigating the potential impact of the bill, units less than 15 years old constitute approximately 25% of stock.

The modeling results show that annual rent caps decrease the amount of new construction within affected areas. The visual above depicts that, under a more-restrictive 3% annual cap, there would be an overall 30% reduction in new construction in Denver. Of the 55,963 new housing units estimated to be built by 2030 in Denver, the modeling shows that, under a 3% cap, 16,547 fewer units will be built. Under a less-restrictive 7% annual rent increase cap, it is estimated that 9,348 fewer housing units would be built by 2030 than without a rent cap.

Effect on Property Values

Not only does rent control impact housing supply, but it also decreases the value of both regulated and nonregulated properties. NAA estimates that under a 7% annual rent increase cap, Denver’s apartment buildings alone would cumulatively lose an estimated $462.2 million in property value. In 2021 the average mill levy for a residential property in Denver county was 79.319. With the residential property assessment rate of 7.15%, that amounts to a reduction in local property tax revenue of $2.62 million.

The data show that the vast majority of decreased property values associated with rent control are borne by the owners of properties not subject to rent control. This hurts property owners who have nothing to do with rent control and discourages future institutional investment in the area. The loss of value hurts not only property owners but also decreases property tax revenues of localities that implement rent control due to lower property values. As a consequence, local governments which enact rent control policies may need to cut spending or increase taxation to accommodate the lost revenue.

- A study conducted in Cambridge from 1994–2004 found that the repeal of rent control increased property values by $2 billion.[viii]

- Of this $2 billion, only $300 million was accounted for by rent-controlled units. The other $1.7 billion added in property value belonged to properties that were never regulated by rent control.

- Autor, Palmer, and Pathak (2014) found that “newly decontrolled properties’ market values increased by 45%.”[ix]

Though rent control continues to be discussed as a policy tool to address housing affordability, the evidence shows that it creates a slew of long-term negative consequences for both housing supply and property values that outweighs any short-term and isolated benefits.

The debate over rent control as a solution to housing unaffordability continues to be a contentious issue. While rent control may seem like a logical solution to rising housing costs, evidence suggests that it can have significant unintended consequences on the housing market, particularly on the supply of new housing units. The potential negative impact on housing supply in Denver, estimated to be as high as 17,000 units by 2030 if rent control is implemented, would be a significant setback in meeting the demand of anticipated future residents and filling the existing supply gap. As lawmakers continue to explore solutions to housing affordability, it is essential to consider all potential consequences, especially those with strong evidence that they undermine the very goals of the policy in the long run.

[i] C:\1115_01.txt (colorado.gov)

[ii] HB1115_L.004.pdf

[iii] The Effects of Rent Control Expansion on Tenants, Landlords, and Inequality: Evidence from San Francisco (aeaweb.org)

[iv] Behind New York’s Housing Crisis: Weakened Laws and Fragmented Regulation - The New York Times (nytimes.com)

[v] Forty years of rent control: Reexamining New Jersey’s moderate local policies after the great recession - ScienceDirect

[vi] https://commonsenseinstituteco.org/colorado-housing-quarterly-update/

[vii] https://www.naahq.org/sites/default/files/naa-documents/modeling_the_impacts_of_rent_control.pdf

[viii] https://www.dcpolicycenter.org/publications/rent-control-literature-review/#_ftnref3

[ix] Housing Market Spillovers: Evidence from the End of Rent Control in Cambridge Massachusetts | NBER