Executive Summary

Colorado has rapidly become one of the most expensive states to live in the country. High population growth combined with a sustained underproduction of new housing has led to a highly strained housing market. With an estimated housing unit shortfall between 93,000 to 216,000 units, and the fluctuations in demand amidst the pandemic, the average cost of for sale homes and median rents have skyrocketed.

As tensions rise across Colorado cities in response to housing unaffordability, the urgency to address the housing unit shortfall has stirred the State Legislature to act. $1.2B

[i] of the American Rescue Plan Act’s one-time funding was allocated towards a myriad of affordable housing initiatives in 2021 alone.

To address the unit production shortfall, Proposition #123

[ii] has qualified for the ballot, requesting that Coloradans dedicate 1/10th of 1% of federal taxable income from the State’s General Fund to create Colorado’s first statewide voter initiated affordable housing fund. While the measure does not increase tax rates, the money transferred to the new affordable housing fund will lower future TABOR refunds by an equivalent amount. In years with no TABOR refund, the transferred funds would normally be allocated to other state uses which will require monitoring in future years. Like it or not, Proposition #123 interfaces with the deeply entrenched cultural elements that TABOR presents in the minds of Colorado voters.

It’s not hyperbole to state that Proposition #123 is an ambitious measure that has the potential to drive transformational changes to our Colorado housing market. The measure presents a number of exciting new tools such as:

- A dedicated and permanent affordable housing funding mechanism, 3X the Division of Housings 2021 state allocation, that empowers the state to address the ongoing subsidy needs of affordable housing development[iii]. This is a segment of the demand for affordable rental and home ownership that the non-subsidized market struggles to serve under today’s constraints.

- A Fast Track Approval Policy focused on reducing the elongated, costly housing approval process timelines that are plaguing Colorado local governments. The 90 Day Fast Track Approval Process, a requirement of local government participants, is an evidence-based[iv] mechanism to reduce the overall cost of affordable housing production that if embraced by local governments, has the potential to deliver affordable housing units to market in a far more efficient manner.

- Funding for Land Banking to purchase and hold land via grants and low interest loans helps local governments and developers “attack the cost” allowing a greater percentage of affordable housing projects to “pencil out”[v] across Colorado’s high-cost real estate markets.

- A Tenant Equity Vehicle, which addresses the lack of wealth building opportunities impacting renters whose average net wealth is $8,000[vi] compared to $300,000 for homeowners as of 2021, by providing a means to vest renters in the program’s performance “via funding for a down payment for housing or other related services.”

However, there are challenges the measure presents that require attention.

Stated bluntly, the measure is only as successful as the number of local governments that decide to opt into the program. If the capture rate of local governments is weak, due to any number of reasons, the program will be faced with a multitude of challenges.

- First, is the uncomfortable reality that Coloradans who have voted for the successfully adopted measure could fail to benefit from its investments, due to their local government choosing not to opt in.

- Secondly, if the measure struggles to enroll local governments, the fund may grow larger with each passing fiscal year. With a lack of performance that is subject to fierce scrutiny at the state legislature. Facing competing state priorities for other critical budgetary needs at the risk of lawmakers reappropriating the funds increases exponentially.

- Furthermore, as the program administrator, the Division of Housing within the state Department of Local Affairs, will face intense pressure to be flexible and respond to local government demands with key requirements such as the 3% growth targets and fast track approval process, in order to enroll as many jurisdictions as possible. The pressure to enroll local governments sets the stage for disaggregated, and inconsistent standards across the state, straying from the original intent of the measure, mitigating the value proposition of the measure as written.

Additionally, while the measure does not raise tax rates, it transfers 1/10th of 1% of federal taxable income from the state’s General Fund, to fund affordable housing programs - funding that would normally be earmarked for other uses, the General Assembly's Joint Budget Committee (JBC) must evaluate the program outcomes closely. In the years ahead, the JBC must ensure the measures outcomes are commensurate with the people’s investment, providing the required rate of return as it relates to the measures interaction with other critical state budgetary needs.

To address the challenges the measure presents, and maximize its strengths, proponents, supporters, elected officials and Coloradans alike should consider the following recommendations if the measure passes.

- Address the Potential of a Growing Fund Balance - Institute a Performance Based Cap.

- Address the Risk of Reappropriation - “Re-Bruce” Any Reappropriated Funds.

- Resist Attempts to Loosen the Measures Requirements for Accepting Funds - Stay True to the Measures Value Proposition.

- Resist Hyper Localism - Incentivize Local Governments to Adopt Regional Fast Track Approval Policies.

- Drive Continuous Improvement - Require a Periodic Fund Performance Analysis.

Introduction

Good luck trying to find an affordable home in Colorado, be it for rent or for sale; they simply do not exist. As CSI’s recent Colorado Quarterly Housing Update

[vii] starkly illustrates, due to elevated home prices and rising interest rates, the affordability of purchasing a home is at its lowest point in 33 years. As such, it should not come as a surprise that 98% of Coloradans live in a county with an aggregate housing supply shortage, with unit deficit estimates as of 2020 ranging between 93,000 to 216,000; a byproduct of chronic housing production shortfalls following the Great Recession that did not cease until shortly before the COVID19 Pandemic.

While building permits have trended up in Colorado with 2021 delivering a 40% increase over the previous five years, Colorado counties continue to struggle to deliver the housing units required to meet their population’s current and future demands.

Complicating matters moving forward is the contracting American housing market, which in 2022 has seen new single family housing unit production contract by 10.6% across the nation. This is the first decline nationally since 2011. The multifamily segment which includes apartments and condos has experienced an 8.6% reduction per National Association of Home Builders Chief Economist Robert Deitz.

[viii] As Coloradans have learned, failing to meet our annual new housing unit targets places significant pressure on our housing market, causing rents and home prices to rapidly eclipse what Coloradans can afford.

As Colorado grapples with our ongoing housing unit shortfall, a reduction in annual housing permits is a significant threat to our state economy and the well-being of our citizens. To address this threat head on, a new housing measure, Proposition #123, will appear on the 2022 statewide ballot. The Proposition proponents state it will deliver the funding to support the creation of 170,000 new affordable housing units over 20 years.

[ix] If the measure passes, it will add to the significant affordable housing investments passed by the State Legislature in recent sessions, with over $650 million

[x] allocated in the 2022 session alone.

While funding for affordable housing is a critical need, it alone is not the root cause of our housing unit deficit. The additional critical factor is the systemic issues presented by what Freddie Mac

[xi] states is exclusionary local land use, planning and zoning regulations, which the measure does not specifically address.

As many other states have shifted their affordable housing strategies to address exclusionary zoning regulations via statewide housing policy interventions

[xii], the deeply entrenched ethos of local control, home rule governance has stalled the deployment of statewide housing policy interventions here in Colorado. Rather, state policy has focused on a carrot versus the stick approach in this regard, notably via recent legislation like The Department of Local Affairs Innovative Affordable Housing Strategies

[xiii] which incentivizes local governments to change their entitlement processes in return for access to technical assistance and funding for affordable housing initiatives. This incentive-based approach to addressing the challenges of local entitlement policies remains what Colorado lawmakers and now, the proponents of Proposition #123 are counting on as the most viable solution that will be amenable to all Coloradans. At this moment these policy approaches take the place of the designation of housing entitlement policies as a matter of statewide concern and the subsequent deployment of greater uniformity. It remains to be seen if the current Coloradan dedication to local control housing policy will be a more productive strategy when compared to other states. What is clear is that Proposition #123 requires robust local government engagement.

This herein lies the measures strengths, challenges and ultimate success, first at the ballot box this fall and then if passed, the willingness of Colorado cities and counties to voluntarily opt in to gain access to the funding provided by Proposition #123.

Proposition #123, “Dedicated State Income Tax Revenue for Affordable Housing Programs”: An Overview

What is Proposition #123 and what does it do?

- This measure sets aside 1/10th of 1% of annual tax revenue to fund affordable housing programs - with no cap or sunset.

- This measure requires the creation of 90-day Fast Track Approval policies by participating local governments.

- This measure requires participating local governments identify annual affordable housing development targets of 3% growth per year that must be achieved to maintain eligibility over a three-year commitment cycle.

- This measure defines affordable housing via two factors: household income and housing costs to include utilities. The measure applies to renters earning <60% of the Area Median Income, or homeowners earning <100% of the Area Median Income.

- This measure requires the weighted average cost of all participating project units not to exceed 30% of the households’ income, inclusive of incremental utilities costs.

What Proposition #123 is not:

- This measure does not require local governments to participate - they can choose not to engage the fund if they so desire.

- This measure does not require that local governments change their current land use, planning and zoning policies.

- This measure is not a panacea and, won’t on its own volition, solve the affordable housing unit shortfall impacting Colorado.

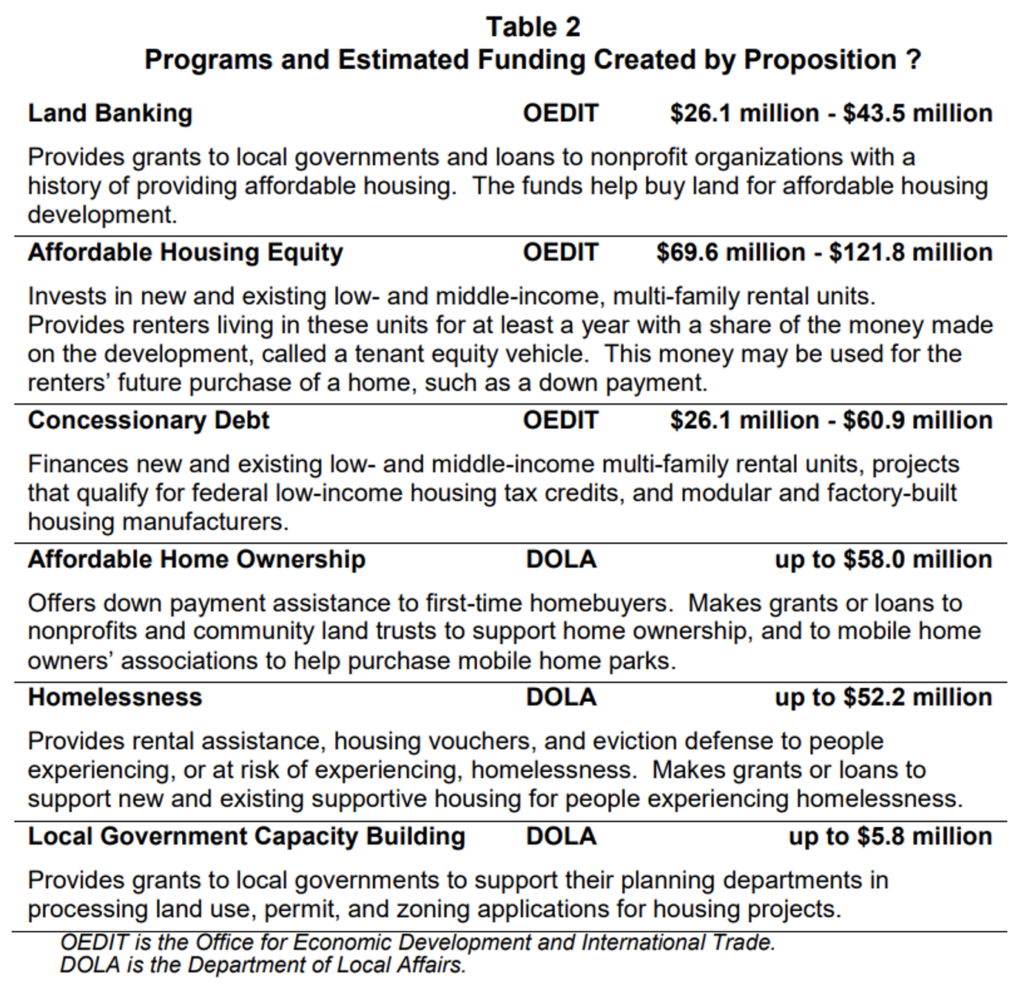

To better understand the potential attractiveness of Proposition #123, let’s first look at what Proposition #123 is proposing. The measure asks Coloradans to invest 1/10 of 1% of federal income tax revenue from the State General Fund. It is estimated to collect $290M in fiscal year 2022/2023 for the purpose of affordable housing programs to be administered by The Office of Economic Development and International Trade who will transfer the administration of their share to the Colorado Housing and Finance Authority and the Division of Housing within the Department of Local Affairs. The measure provides funding for a number of dedicated uses across the housing continuum as seen below:

Image Source: Colorado Legislative Council Staff Draft Blue Bool Analysis

Proposition #123’s Strengths

By providing a dedicated funding stream to all major segments of the affordable housing spectrum from homelessness to homeownership, with no sunset, Proposition 123 looks to address all segments of the Colorado affordable housing continuum. Here are several strengths within the measure.

- The Creation of Fast Track Approval Policies

- Housing permitting times are one of the most challenging aspects of developing affordable housing, for both developers and local governments. Time costs money and the longer housing permitting process take, the greater the impact on the cost of the development. A recent James Madison Institute study focused on southern Florida found that permitting delays added $6,900[xiv] to the cost of a typical home. While the decision to include a Fast Track Approval process as a requirement to access the funds is a gamble that we will discuss in detail later in this analysis, reducing housing development approval times is an evidence-based approach to reducing the overall cost of housing development and should be celebrated if achieved.

- Land Banking

- Developing real estate is a costly affair, with the cost of land being a significant barrier to the development of affordable housing. While traditional land banking programs are focused on addressing tax delinquent properties as a means of addressing blight in weak real estate markets, Proposition #123 utilizes land banking as a means to assist local governments and nonprofit developers in the acquisition of land, with patient capital, to allow development in the near future. By providing grants to local governments, such as Public Housing Authorities, and low interest loans to non-profit organizations to acquire and preserve land for the development of affordable housing with a mechanism to allow for the forgiveness of a loan if the land is zoned within 5yrs and permitted for development within 10yrs, the measure provides a vital resource for affordable housing developers to compete for desirable, costly land at a cost basis that can “pencil out” a project that otherwise would not be viable. Providing a mechanism and subsequent funding in this manner is a proven tool utilized to reduce the total cost of a development's construction and will be a significant strength of the measure if passed.

- Division of Administrative Oversight

- The Division of Administrative oversight between the Colorado Division of Housing and The Colorado Housing Finance Authority positions the fund to accomplish its mission. This division of administrative duties also provides a much-needed A/B test amongst the two entities. This allows lawmakers and leaders the ability to evaluate the effectiveness of administration to best drive continuous improvement with the agencies.

- A Tenant Equity Vehicle

- One of the most innovative and exciting elements of the Proposition happens to be flying under the radar, found deeper in the language of the Initiative: The Tenant Equity Vehicle (TEV). TEV is something unique, and inspirational, which has the potential to change the lives of Coloradans who stand to benefit not only by gaining an affordable home from the program’s investments, but also from the overall fund’s fiscal performance. While the Proposition does not delineate exactly how the TEV will function, the structure as written in the Proposition states: “residents in projects funded by the program for at least one year will be entitled to funding from the program for a down-payment on housing or related purposes.”[xv] This is to be accomplished by capturing “returns on program investments greater than the program’s Proposition investment shall be retained in the program to fund the Tenant Equity Vehicle.” We eagerly await the future announcement of the TEV structure and encourage the drafters to empower direct cash transfers in the form of no less than annual dividends triggered by clearly articulated program goals made available to the public annually.

Proposition #123’s Challenges & Threats

What’s

not to like about Proposition 123, you ask? Well, not everything about Proposition 123 is rainbows and moonbeams. While the Proposition has many strengths, it makes a few large bets. If they do not play out as forecasted, they could significantly hinder the measures success and introduce material threats - let’s dig in, shall we?

The Taxpayer Bill of Rights (TABOR)

- TABOR Remains Top of Mind for Colorado Voters

- While Proposition #123 is not a tax increase, since it calls to source funds from the State General Fund, the fund will reduce future TABOR refunds by a proportional amount, requiring the measure to address the TABOR dynamic regardless. In a state governed by, and influenced culturally by TABOR[xvi], the Proposition will face headwinds at the ballot box that should not be understated.

- Capture Rate - Will Local Governments Opt-In?

- Stated bluntly, Proposition #123 is only as successful as the number of cities and counties who decide to opt into the program. If the capture rate of jurisdictions is weak, due to any number of reasons, the program will be faced with a multitude of challenges. Thus, setting up an uncomfortable reality where Coloradans who have voted for the successfully adopted measure could be on the outside looking in, unable to benefit from the measures investments due to their local government choosing to not opt-in.

- Risk of Reappropriation

- Consider this plausible scenario: The fund, which has no cap, struggles to enroll local governments. As a result, the fund grows larger each fiscal year. With a lack of outcomes that are subject to fierce scrutiny and critique at the state legislature, while also facing competing priorities for funding from the state legislature, lawmakers could easily and legally reappropriate[xvii] the funds to address other critical state funding needs, be it K-12 funding, infrastructure, etc. Additionally, the risk of reappropriation is amplified due to the funds being TABOR exempt which poses incremental state budget risk. While the measure attempts to safeguard the fund from actions such as this, precedent demonstrates that the legislature has legal solid ground to reappropriate funds as they deem necessary. The proponents believe that lawmakers would be hard pressed to reallocate funds following the strong support and will of the Coloradan voters who passed the measure - but will they?

- Will The Measure Provide Outcomes Commensurate to the People’s Investment?

- The measure exists to help close the gap of affordable housing units across Colorado. To accomplish its purpose, the measure does not raise taxes, rather it transfers 1/10th of 1% of federal taxable income from the State’s General Fund, to fund affordable housing programs, funding that would normally be earmarked for other budgetary uses. This presents the General Assembly's Joint Budget Committee (JBC) a new dynamic that must be evaluated closely should the measure pass. In the years ahead, the JBC must ensure the measure’s outcomes are commensurate with the people’s investment, providing the required rate of return as it relates to the measures interaction with other critical state budgetary needs.

Proposition #123’s Impact on TABOR

Proposition #123 asks Coloradans to approve a state revenue change and thus is not subject to Colorado’s constitutional revenue limit, commonly referred to as the Taxpayer’s Bill of Rights (TABOR). The measures draft ballot analysis states the TABOR impact as such:

“In years where state revenue exceeds the TABOR limit, the measure reduces the money returned to taxpayers by the amount of income tax revenue that that the measure allows the state to keep. In years where state revenue is below the TABOR limit, the measure does not impact TABOR refunds, but may reduce the amount of money available for the rest of the state budget. In this case, the measure allows the state legislature to reduce part of the new funding to the affordable housing programs to balance the state budget. The state currently expects to return money collected above the limit through at least the 2023-24 budget year.”

Proposition #123’s Impact on Colorado Taxpayers per the draft ballot analysis:

- Colorado is forecasted to exceed the TABOR revenue limit in tax years 2023 and 2024

- #123 will decrease the amount returned by $145M in 2023

- Decreasing the amount returned by $43 per taxpayer

- #123 will decrease the amount returned by $290M in 2024

-

- Decreasing the amount returned by $86 per taxpayer

-

Getting to Brass Tacks… Are 3% Growth Targets Feasible?

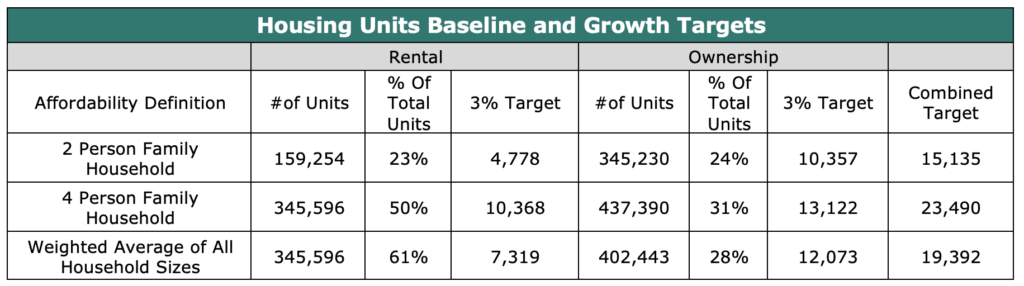

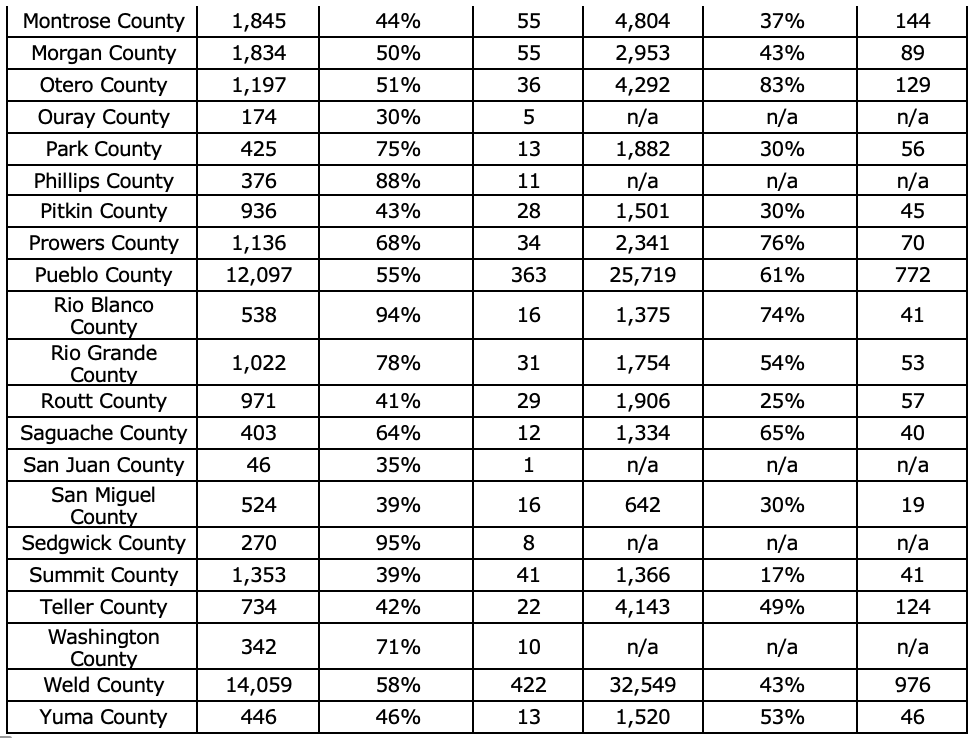

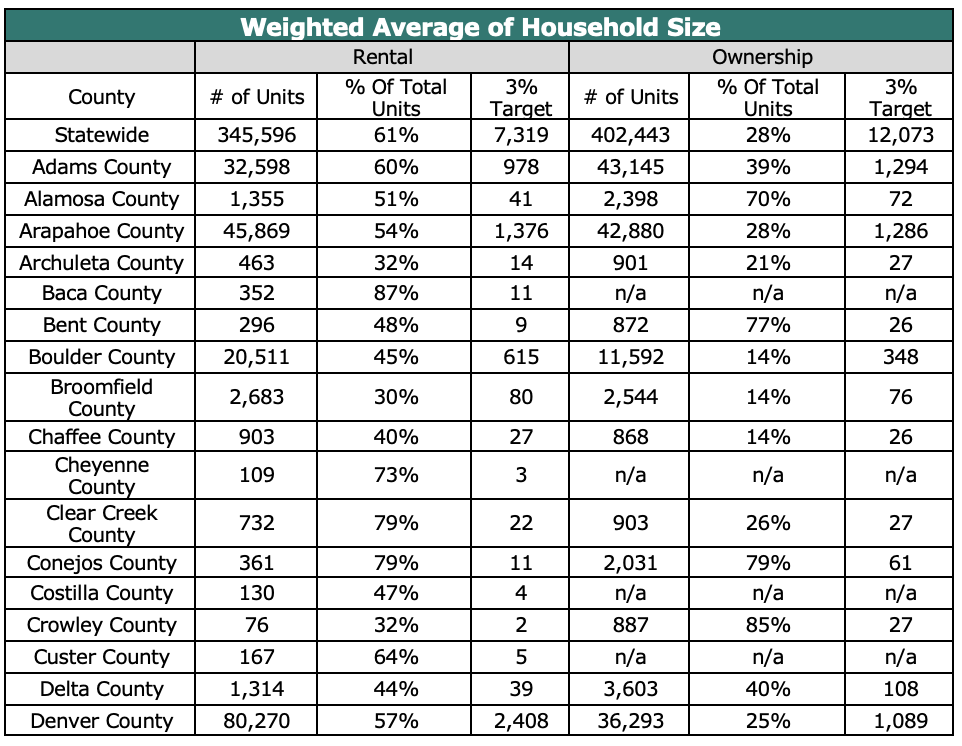

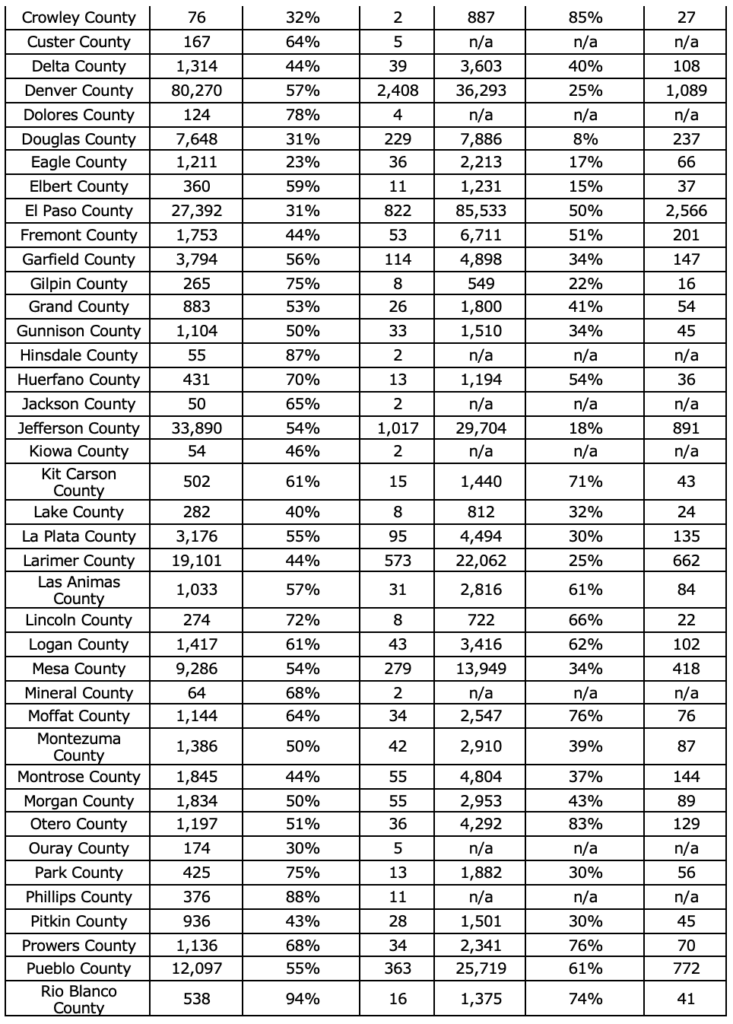

Let's start by discussing how Proposition #123 determines a local government's baseline of existing affordable housing units. This determines the number of permitted units required to meet their 3% new affordable housing unit target in the first three-year cycle.

-

-

- No later than November 1, 2023, the governing body of each local government shall make and file with the Division of Housing a commitment specifying how by December 31, 2026, the combined number of newly constructed affordable housing units, and existing units converted to affordable housing, within its territorial boundaries will be increased by 3% each year over the baseline number of affordable housing units within its territorial boundaries.

- In the case of a county government applying for the funds, the requirements only apply to the unincorporated areas of the county.

- The baseline number of affordable housing units within the territorial boundaries of a local government shall be determined by the local government via:

- Referencing the (to be published) 2017 - 2021 American Community Survey Tool as published by the United States Census Bureau; or

- The most recently available Comprehensive Housing Affordability Strategies Estimates published by the United States Department of Housing and Urban Development; or

- A web-based system created and maintained by the Division of Housing with the estimates specified from option one or two.

- “If the Division of Housing finds that the estimates specified would be deleterious to the efficacious implementation of this requirement an alternate source of estimates that the Division of Housing finds appropriate is premised.”

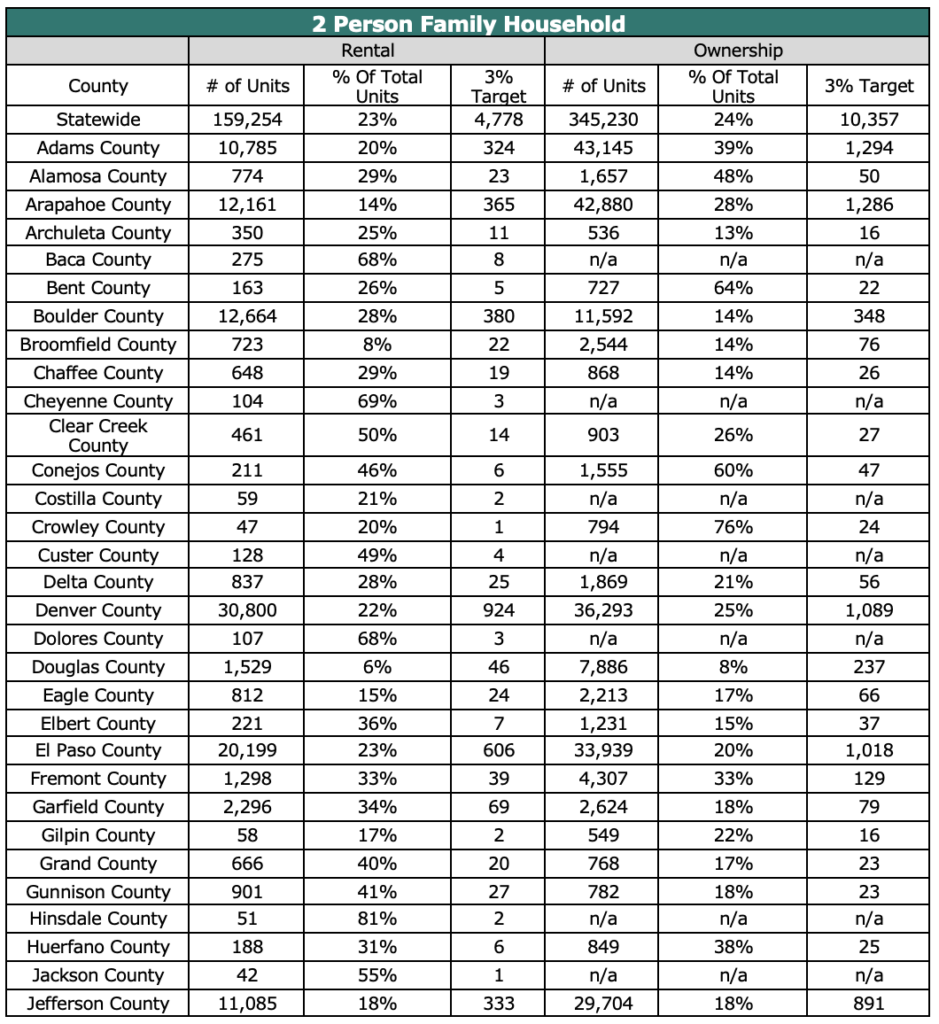

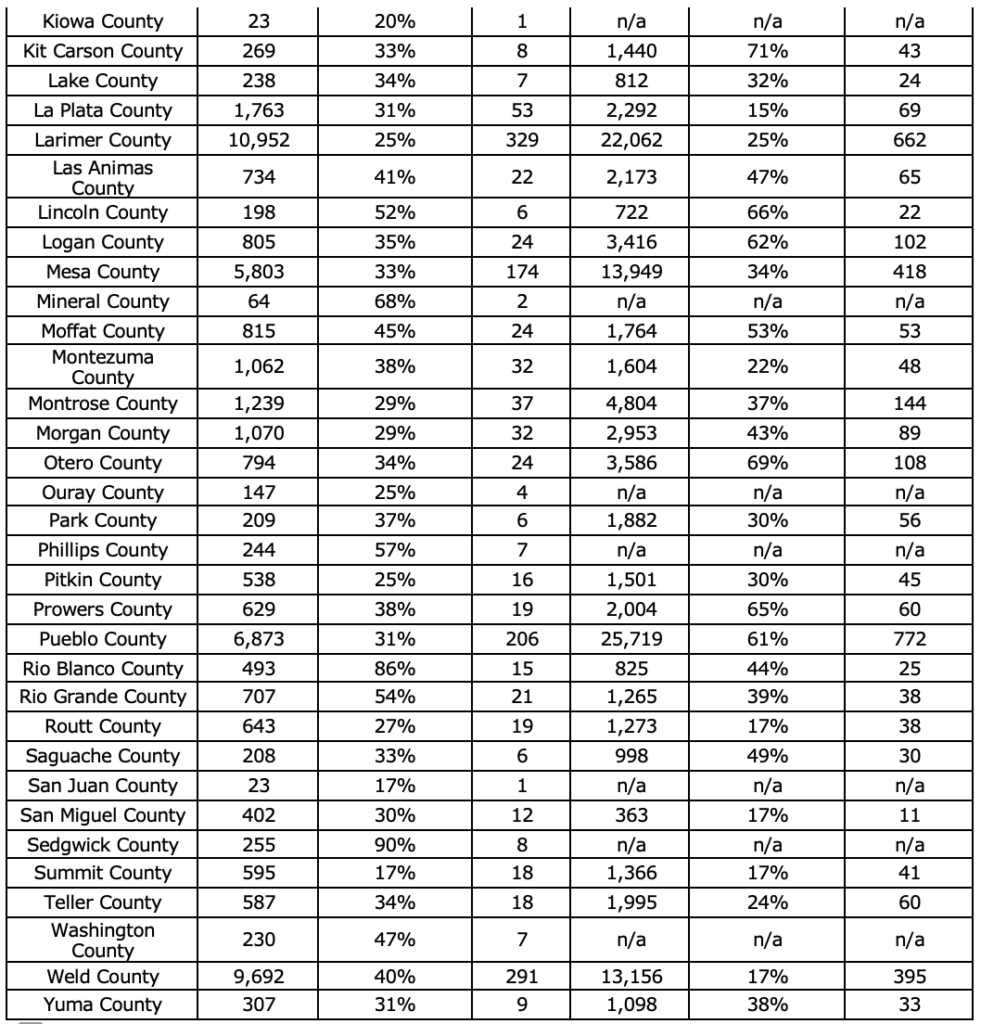

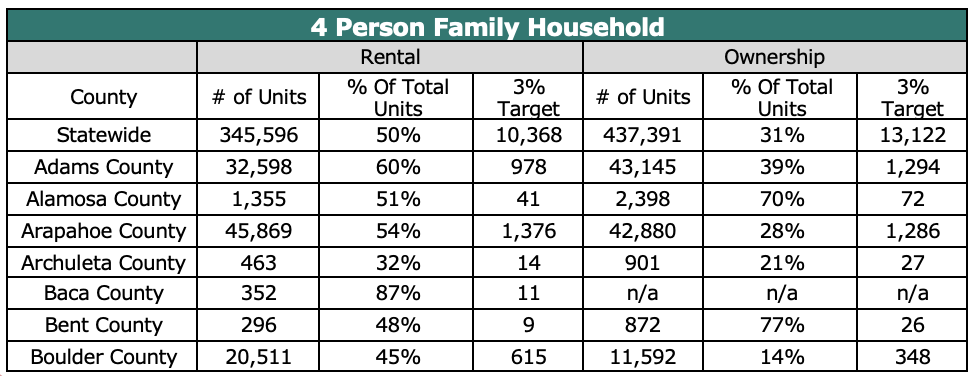

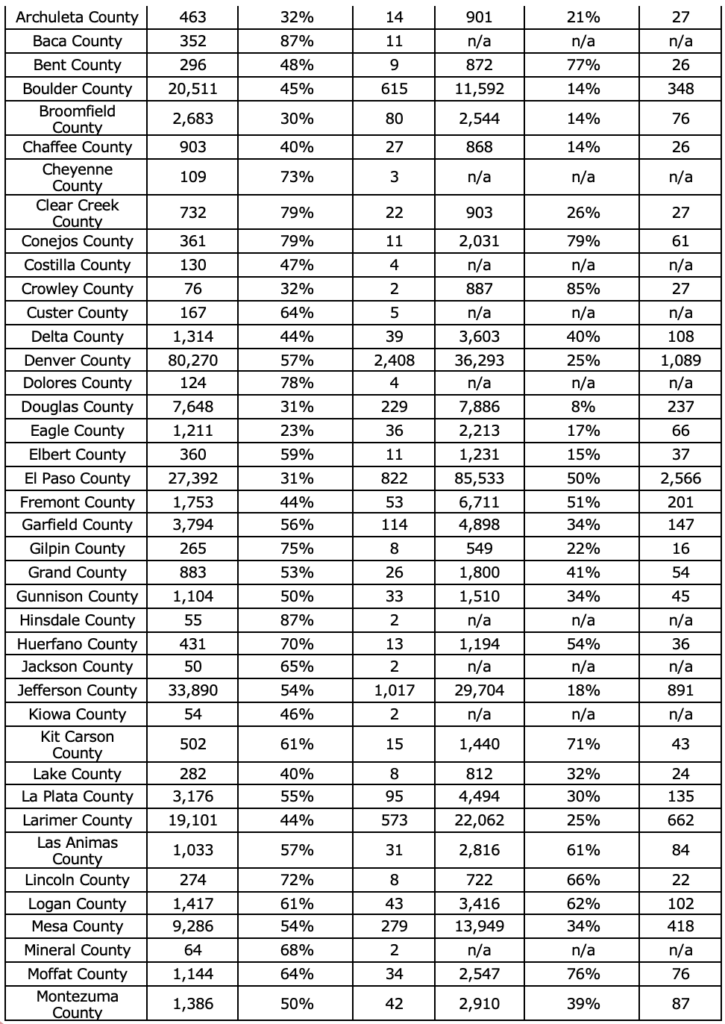

For this analysis, the most recently available 2016-2020 American Community Survey Tool as published by the United States Census Bureau was utilized. The ballot measure stipulates that the 5-year 2017-2021 estimates need to be used, however those estimates are not published at the time of this report.

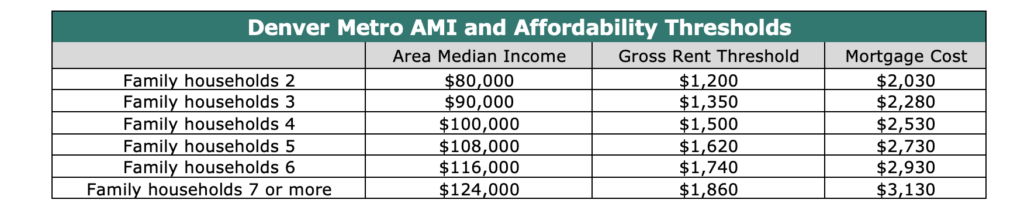

There are separate affordability standards in the measure for rental units and units available for home ownership.

-

To qualify as an affordable rental unit, the gross rent, inclusive of utilities, must be less than 30% of annual income for a household making at or below 60% of area median income.

- On the home ownership side, the for-sale unit must have a combined mortgage and utility payment below 30% of a household with an annual income at or below 100% of area median income.

While a general observation suggests that the state’s rental unit baseline appears feasible, the homeownership baseline and target poses a significant challenge to local governments. It is important to note that while the ACS survey may indicate housing units exist across the entire housing stock at a price point that would be considered affordable, the market transaction data is aged, and does not include the rapid escalation of home values experienced across the state throughout the pandemic. As such very few homes are being sold for those prices today. While the new 5–year estimates should reduce the homeownership baseline and target, local governments will be evaluating their homeownership baselines closely as they analyze opting into the program.

While this analysis attempts to adhere to the steps as stipulated in the ballot measure, in the event that a local government, or perhaps multiple local governments consider their baselines and growth targets not achievable, the measure provides a means for relief and reconsideration via petitioning the Division of Housing. The measure empowers DOH to choose an alternate source of estimates that they find appropriate, should they consider the starting baseline “deleterious to the efficacious implementation of this requirement.”

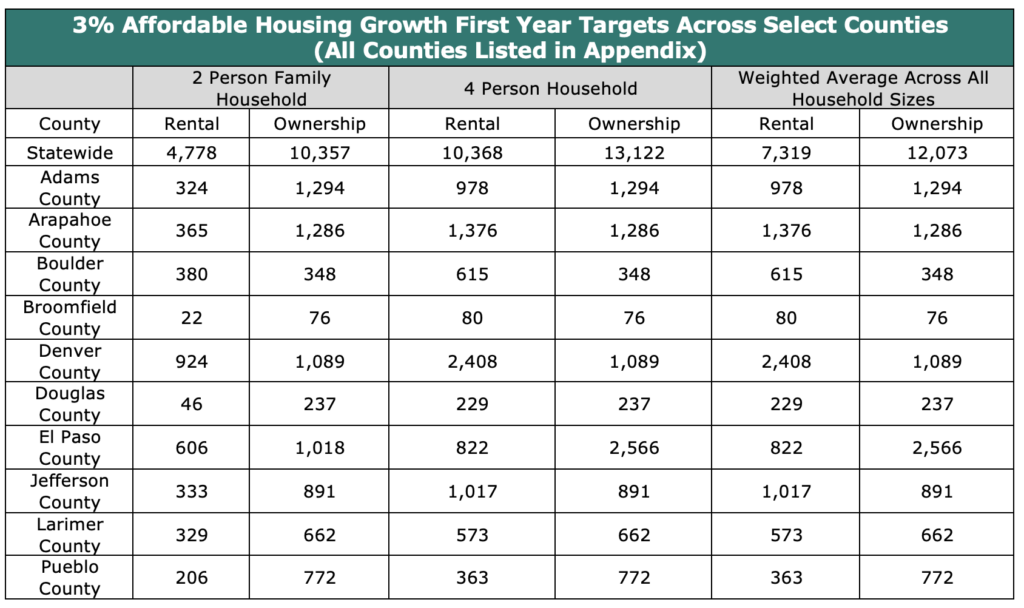

So, let us review the baselines and growth targets for the Counties listed in the table below, and place ourselves in the shoes of a city or county manager, who will be tasked with making a recommendation to their elected officials as to the feasibility of meeting the measure’s requirements of opting in. The question facing decision makers is simple. Does this look feasible, can these growth targets be achieved?

While a general observation suggests that the state’s rental unit baseline appears feasible, the homeownership baseline and target poses a significant challenge to local governments. It is important to note that while the ACS survey may indicate housing units exist across the entire housing stock at a price point that would be considered affordable, the market transaction data is aged, and does not include the rapid escalation of home values experienced across the state throughout the pandemic. As such very few homes are being sold for those prices today. While the new 5–year estimates should reduce the homeownership baseline and target, local governments will be evaluating their homeownership baselines closely as they analyze opting into the program.

While this analysis attempts to adhere to the steps as stipulated in the ballot measure, in the event that a local government, or perhaps multiple local governments consider their baselines and growth targets not achievable, the measure provides a means for relief and reconsideration via petitioning the Division of Housing. The measure empowers DOH to choose an alternate source of estimates that they find appropriate, should they consider the starting baseline “deleterious to the efficacious implementation of this requirement.”

So, let us review the baselines and growth targets for the Counties listed in the table below, and place ourselves in the shoes of a city or county manager, who will be tasked with making a recommendation to their elected officials as to the feasibility of meeting the measure’s requirements of opting in. The question facing decision makers is simple. Does this look feasible, can these growth targets be achieved?

The question now becomes, will the Division of Housing enact their ability to locate and utilize “an alternate source of estimates that the Division of Housing finds appropriate,” and if so, how?

While the measure empowers the Division to enact this clause, the Division should strive to ensure that modifications do not undermine the will of the voters, identifying new baselines and growth targets that drive incremental affordable housing unit creation across local governments, in a transparent and consistent manner.

The question now becomes, will the Division of Housing enact their ability to locate and utilize “an alternate source of estimates that the Division of Housing finds appropriate,” and if so, how?

While the measure empowers the Division to enact this clause, the Division should strive to ensure that modifications do not undermine the will of the voters, identifying new baselines and growth targets that drive incremental affordable housing unit creation across local governments, in a transparent and consistent manner.

Can Cities and Counties Create, Implement and Adhere to a 90 Day Fast-Track Approval Process?

The challenge now becomes not only do local governments have to deliver 3% more affordable housing units per year, but they must also create a pathway to ensure the 3% is achieved. To accomplish this, Proposition #123 requires local governments to create a Fast-Track Approval Process. Let’s look at this in greater detail.

Here’s how Proposition #123 defines the 90 Day Fast-Track Approval Process

-

Local Governments must establish processes to enable it to provide a final decision on any application for a special permit, variance, or other development permit, excluding subdivisions, of a development project for which fifty percent or more of the residential units in the project constitute affordable housing not more than 90 days after submission of a complete application.

- The Fast-Track Approval Process may include the following options:

- Allowing an extension of an additional 90 days at the developer’s request.

- Allowing an extension of an additional 90 days for compliance with state law, a court order, or for a review period required by another local government or agency within the local government or agency, within the local government or outside, for any component of the application requiring the governments or agency’s approval.

- Allowing an extension for the submission of additional information or revisions to an application in response to requests from the local government.

- Such extensions shall not exceed the amount of time from the request to the submission of the applicant’s response plus 30 days.

- Affordable housing developers are not required to utilize a fast-track approval process.

The commitment to creating, implementing, and adhering to a 90-day fast-track approval process is a significant challenge, both from a technical capacity standpoint within local governments as well as for local elected officials politically. With some local governments across Colorado experiencing approval process timelines eclipsing 12 months,[xviii] crafting fast-track approval processes such as the measure requires, while achievable, will not come easily, even with the extensions factored in.

Recommendations

The following recommendations are designed to maximize Proposition #123’s effectiveness in the event the measure passes. To address both the strengths and challenges the measure poses, we encourage the measure's proponents, supporters, elected officials and Coloradans alike to consider the following recommendations:

Address The Potential of a Growing Fund Balance - Institute a Performance Based Cap

To best ensure that the fund does not grow too large, due to the aforementioned risks and challenges, the Legislature should create a framework to mitigate this risk by setting a Performance Based Cap. This will ensure that the fund remains positioned to address the state's future affordable housing needs, honors the will of the voters, while ensuring that a lack of outcomes does not drive the fund balance to levels that threaten to crowd out other critical needs of the state.

-

The Performance Based Cap is a framework that incentives efficient and timely administration of the funds by the administrators and local government participants to mitigate the risks posed by a growing fund balance.

- In alignment with the measures Three-Year Commitment Cycle the Performance Based Cap will require the Office of Economic Development and The Division of Housing, upon the completion of the first Three-Year Commitment Cycle and each subsequent cycle to produce a Periodic Fund Performance Analysis to the General Assembly detailing the fund’s performance to include the total percentage of funds encumbered during the commitment cycle.

- If the fund fails to encumber no less than 80% (the Encumberment Threshold) of the total transferred to the Housing Fund from the General fund during the completed Three – Year Commitment Cycle, the State Legislature shall reduce the transfer the following year, equal to the Encumberment Shortfall.

- If the fund fails to meet or exceed the Encumberment Threshold, the Division of Housing shall be required to engage a third-party vendor to issue a report identifying the cause of the inability to deploy the required amount of the tax transfer.

- If the funds meets or exceeds the encumberment threshold, no reduction of funding for the upcoming Three-Year Commitment Cycle is premised.

- Any retained earnings held within the fund designated for the Tenant-Equity Vehicle Program shall not be included in the encumberment threshold calculation.

Address The Risk of Reappropriation - “Re-Bruce” Reappropriated Funds

While the measure sets in statute that funds transferred to the new Housing Fund cannot be used for any other purpose, and “may only be temporarily reduced in the event that the Legislative Council Staff March Economic and Revenue Forecast in any given year projects the next state fiscal year will fall below the revenue limit imposed by Section 20 of Article X (TABOR), the General Assembly may temporarily reduce the transfer of funds for one year to balance the state budget for the next fiscal year,” this clause may not be strong enough to eliminate the ability of reappropriation in future years.

-

Should this occur, the reappropriated funds shall lose their TABOR exempt status, and operate as normal General Fund dollars. This honors the measure as written and the will of the voters.

Resist Attempts to Loosen the Requirements for Accepting Funds - Stay True to The Measures Value Proposition

If enacted, the success of Proposition #123 hinges upon its ability to attract and retain local government participation. If local governments view the requirements of opting in as too onerous, the fund will struggle to deploy its capital and create new affordable housing units as required. This dynamic places tremendous pressure on the administrator, the Division of Housing, the responsible party for reviewing and approving local governments baseline averages, 3% growth targets, and fast track approval policies, to be as flexible and local government focused as possible but this would not be in the best interest of Coloradans, if done so on a case by case basis. As discussed in our 2021 fellowship report, “From Conflict to Compassion: A Colorado Housing Development Blueprint for Transformational Change”[xix] my co-fellow Evelyn Lim and I share the pitfalls of our current hyper local, non-standardized, disaggregated, entitlement policies. Colorado would be wise to resist replicating the dynamic here again via hyper individualized fast track approvals policies that differ from one local government to the next, straying materially from what is stated in the measure.

-

The Division of Housing should be judicious, consistent, and transparent in their approval methodologies, and promote the adoption of regional fast track approval policies.

- In the event that the Division of Housing deems Local Government Affordable Housing Baselines as defined currently in the measure via the ACS or CHAS models as “deleterious to the efficacious implementation of this requirement,” and utilizes “an alternate source of estimates that the Division of Housing finds appropriate,” the Division should implement the new estimates in a uniform and consistent manner across Local Governments.

- The Division of Housing, upon the completion of the first Three-Year Commitment Cycle and each subsequent cycle shall be required to report to the General Assembly via the Periodic Fund Performance Analysis, detailing the baseline averages, 3%-unit growth targets and fast-track approval policies approved by the Division.

Resist Hyper Localism - Incentivize Local Governments to Adopt Regional Fast-Track Approval Policies

In our current local control housing regulatory environment, local governments struggle to meaningfully collaborate with neighboring local governments via shared housing entitlement policies. This lack of consistency hinders the economies of scale[xx] required to drive down per unit cost across the housing development value chain. In our current status quo it is highly probable that the number of fast-track approval policies created will be equal to the number of participating local governments. We propose a different path for Colorado:

-

The General Assembly should empower the Division of Housing to incentivize local governments that join into Regional Fast-Track Consortiums. These regional consortiums will share fast track approval policies that resist significant deviation amongst themselves to drive clear and consistent practices that promote the facilitation of affordable housing unit requirements

- Incentives to be considered may include:

- Increased Technical Assistance Funding

- Increased Administrative Support Funding

- Dedicated/Concierge Division of Housing & CHFA Administrative Staff Support

- Dedicated Access to Funding for Offsite Improvements for Qualifying Projects

- Dedicated Access to Funding for Water Taps for Qualifying Projects

- Low Income House Tax Credit Basis Boost for Qualifying Projects

Drive Continuous Improvement - Require a Periodic Fund Performance Analysis

Analysis of the funds’ performance is critical to the measure's success. As currently written the measure does not specifically require nor fund the creation of a periodic fund analysis. To address this omission, we recommend the following:

-

The Division of Housing, upon the completion of the first Three-Year Commitment Cycle and each subsequent cycle shall be required to produce a Periodic Fund Performance Analysis to the General Assembly analyzing the funds’ performance to include but not limited to:

- Affordable Housing Unit Creation

- Fiscal Performance

- Local Government participation

- Baseline averages, 3%-unit growth targets and fast track approval policies approved by the Division

- Land Banking Activity

- Tenant Equity Vehicle Performance

Conclusion

Colorado’s housing market is failing to meet the basic needs of our growing population, threatening our prosperity, diminishing our quality of life. As the compounding effects of our housing unit shortfall ripples across our communities it endangers our ability to compete regionally, presenting a vicious cycle, for which the status quo no longer suffices. To empower Colorado to achieve its vast potential, we must invest in its most important asset, our people, we Coloradans, who not only deserve, but require an affordable home to pursue happiness. Disrupting the status quo does not and will not come easily, nor without material tradeoffs. While Proposition #123 is not without fault, the measure presents a number of positive elements that if embraced by Coloradans and Local Governments provides a new path to the greater home affordability we so desperately require. To ensure the measure, if enacted, maximizes its value proposition we encourage the proponents, lawmakers, and Coloradans across the state to embrace the recommendations posed and challenge ourselves to expand upon the strengths of the measure and reimagine not only the elements that will constitute Fast Track Approval Policies but to also reimagine and reform our local land use, planning and zoning regulations writ large.

© 2022 Common Sense Institute

Appendix – County-wide Level Estimates of Affordable Housing Baseline and Growth Targets

[i] Legislative Council Draft: Prop 123- Dedicate Revenue for Affordable Housing Programs

[ii] Prop. 123 Ballot Text

[iii] Capital subsidies for building affordable housing developments - Local Housing Solutions

[iv] Expedited permitting and review policies encourage affordable development | National Housing Conference (nhc.org)

[v] The cost of affordable housing: Does it pencil out? (urban.org)

[vi] By Race (nar.realtor)

[vii] Colorado Housing Quarterly Update | Common Sense Institute (commonsenseinstituteco.org)

[viii] Housing Recession Deepens - NAHB

[ix] Solution — Make Colorado Affordable (yeson123co.com)

[x] A new program could help build 16,000 homes in Colorado as part of a bigger $650 million plan | Colorado Public Radio (cpr.org)

[xi] Housing Supply: A Growing Deficit - Freddie Mac

[xii] States can improve housing well-being through thoughtfully designed policies (brookings.edu)

[xiii] Department Of Local Affairs Innovative Affordable Housing Strategies | Colorado General Assembly

[xiv] Assessing the Effects of Local Impact Fees and Land-use Regulations on Workforce Housing in Florida - James Madison Institute

[xv] Prop. 123 Ballot Text

[xvi] TABOR | Colorado General Assembly

[xvii] How Colorado lawmakers closed a $3 billion shortfall to balance the budget and why it led to tears - The Colorado Sun

[xviii] Denver's housing permit backlog plight | Business | denvergazette.com

[xix] From Conflict to Compassion: A Colorado Housing Development Blueprint For Transformational Change | Common Sense Institute (commonsenseinstituteco.org)

[xx] The-next-normal-in-construction.pdf (mckinsey.com)