About this Guide

The purpose of this report is to explain the funding mechanisms and recent spending history of the Colorado Springs municipal budget.

The guide also includes highlights the city budget’s influence over four priority local issues.

- Public Works

- Police and Fire

- Housing

- Homelessness

For more detailed information about the Colorado Springs budget,

visit the cities interactive data tool OpenBudget COS.

All the budget data in this report is from the Colorado Springs Annual Budgets and Budgets in Brief page on coloradosprings.gov/budget. Additional information about topics such as homelessness, housing, and crime is taken from other CSI reports on those subjects.

About the 2023 Budget

The 2023 Colorado Springs Budget was approved December 2022. Internal work on the 2024 city budget began spring 2023 and will be approved by City Council Fall 2023.

The City budget includes spending controlled by the Mayor’s office and City Council in the form of the General Fund. The City budget also includes spending from public enterprises which don’t directly receive tax dollars, and instead generate revenue through fees and other sources.

The budgeted amounts do not reflect actual spending. The city’s Annual Comprehensive Financial Report (ACFR) provides the detail on actual spending. The 2022 ACFR shows General Fund revenue from taxes was $20 million dollars higher than the final budgeted amount. Recent city report indicate that lower than expected sales tax revenue will force a $6 million reduction in 2023 General Fund spending from amount shown in this report.

There are dozens of departments that receive funding through the following

11 appropriating departments:

- City Attorney, City Clerk, Municipal Court

- City Auditor

- City Council

- Finance

- Fire & OEM

- IT

- Mayor & Support Services

- Parks, Recreation, and Cultural Services

- Planning and Community Development

- Police

- Public Works

The

public enterprises included in the budget include:

- Colorado Springs Airport

- Cemetery Enterprise

- Development Review Enterprise

- The Memorial Health System

- The Parking System

- Patty Jewett Golf Course

- Pikes Peak – America's Mountain

- Stormwater Enterprise

- Valley Hi Golf Course

THINGS TO KNOW ABOUT THE COLORADO SPRINGS BUDGET

1. Current Budget

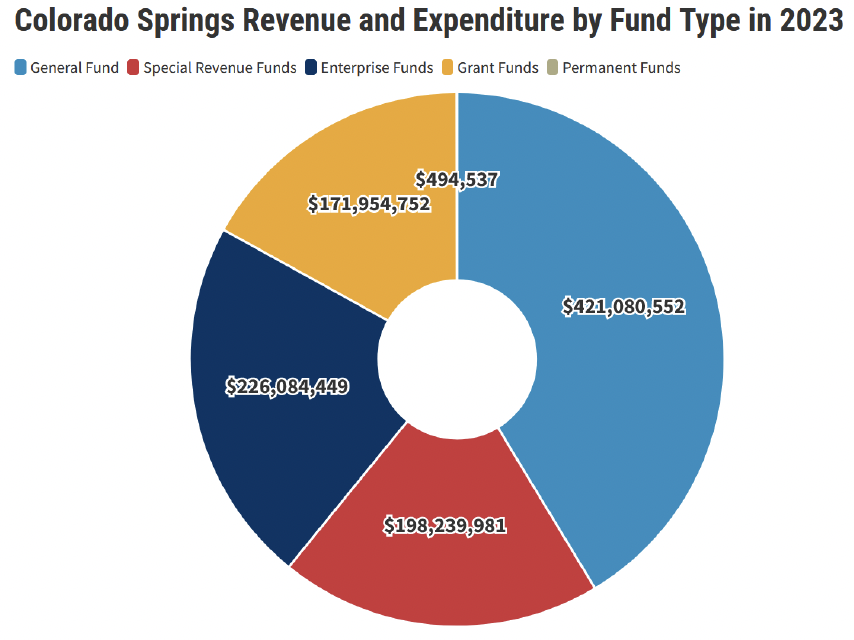

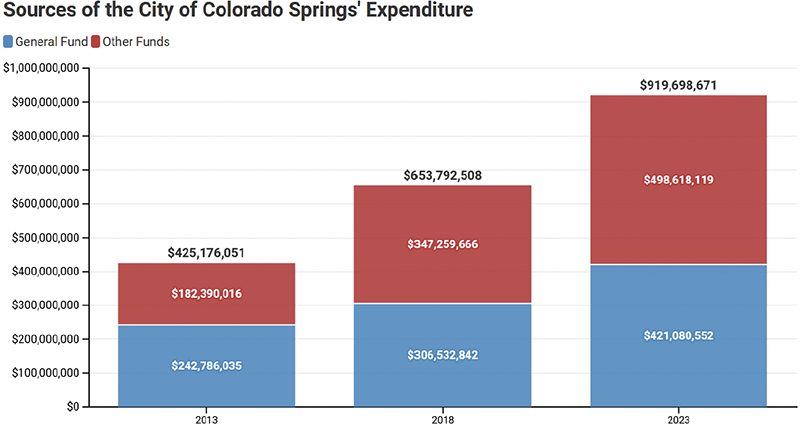

The City of Colorado Springs budget totals $1.017 billion in 2023.

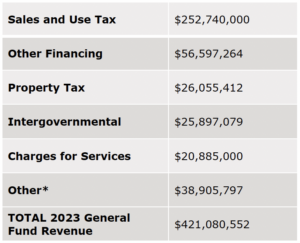

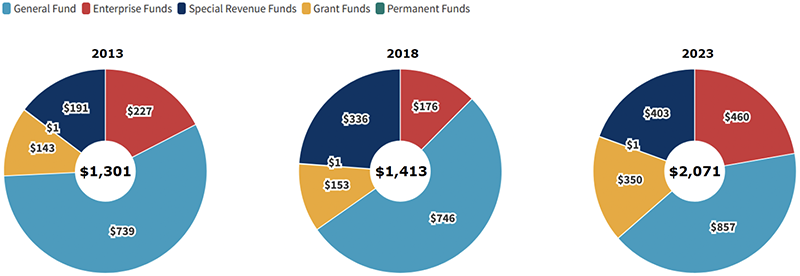

41% of the budget, or $421 million, is spent through the city’s General Fund.

59% is spent through a combination of enterprise funds, special revenue funds, grant funds and permanent funds that generate fees and largely operate outside the control of the Mayor’s Office and City Council. The city’s Annual Comprehensive Financial Report reconciles actual spending from the budget.

2. City Revenue

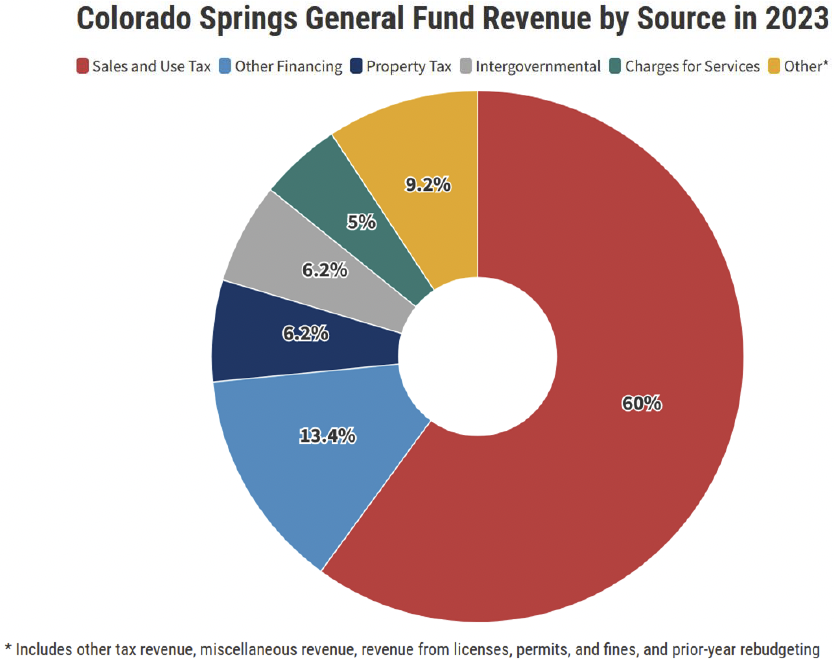

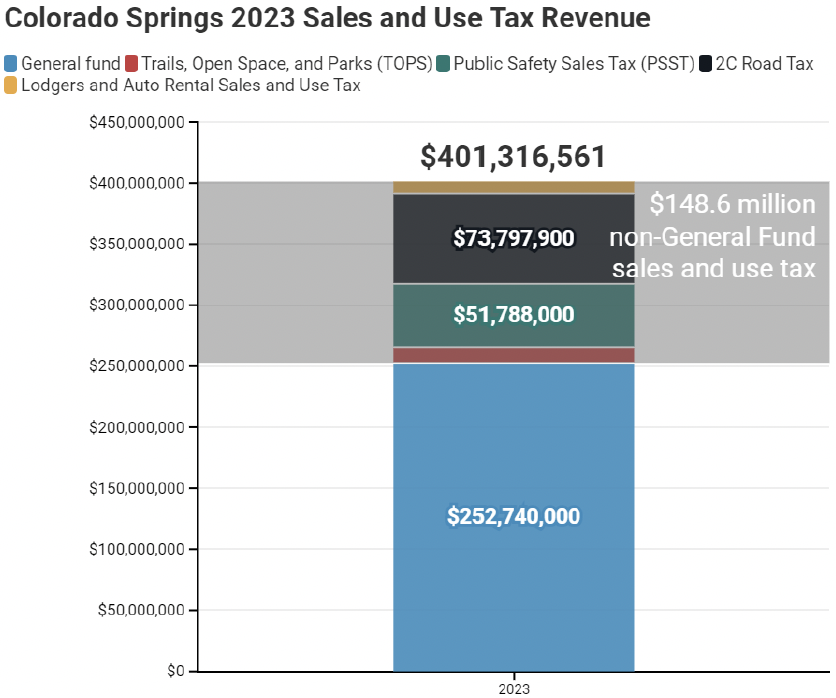

The 2023 budget estimated the city would collect $401 million in sales tax revenue in 2023.

63%, or $253 million was estimated to go towards the city’s General Fund. The remainder is in the form of dedicated revenue from voter-approved sources.

Just 6% of revenue to the city’s General Fund comes from property taxes.

3. Budget Then and Now

Over the last decade, General Fund spending per Colorado Springs resident adjusted for inflation grew 16% (from $739 to $857).

All other spending, including enterprise funds, special revenue funds and other funds, grew by 116% per resident population adjusted basis (from $562 to $1,214), largely from the voter approval of the 2C Road Tax.

4. Shifting Funding Sources

Due to disproportionate growth and expansion of fee enterprises, voter-approved special revenue funds, and grants,

the General Fund's share of total city-government spending has fallen from 57% to 46% since 2013.

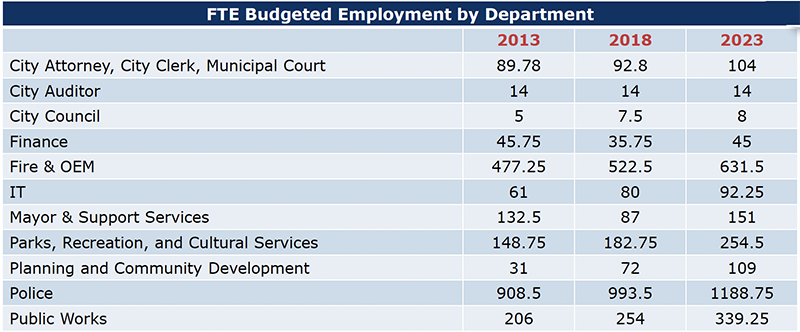

5. Department Funding and FTE

Each city department’s percentage share of the General Fund has remained consistent over the last decade.

General Fund employment growth has been slower than inflation adjusted spending but has grown 45% faster than private employment.

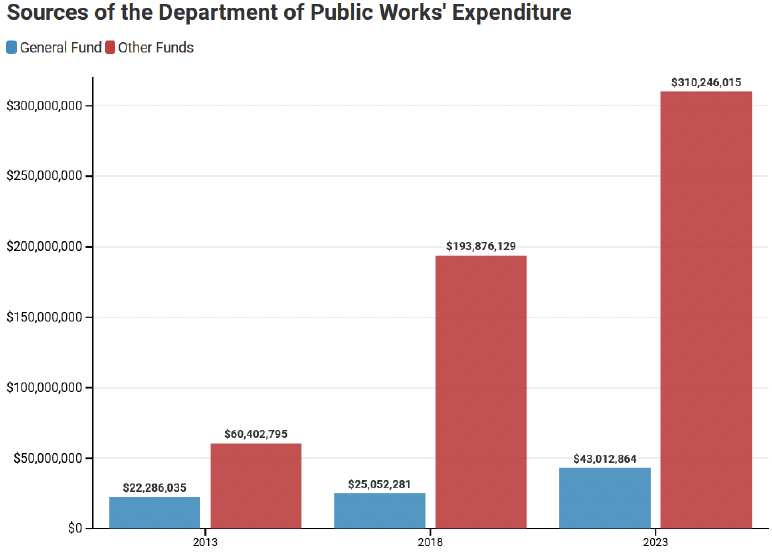

6. Public Works

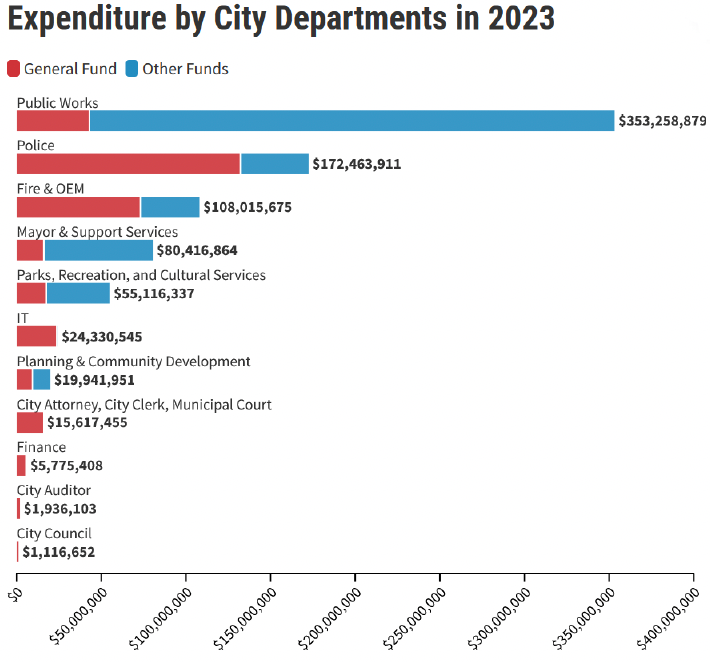

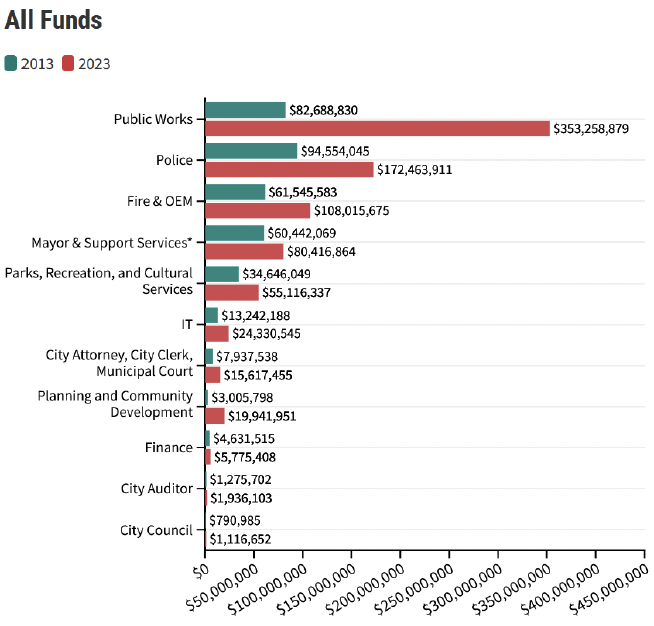

The Department of Public Works is the largest single department in the budget.

The department’s budget grew by 327%, from $82.7 million to $353.3 million over the last decade, increasing its share of total spending from 20% to 35%. $150 million of this growth comes from the creation of the $75 million Stormwater Enterprise and $74 million in voter-approved funding for road maintenance and repairs.

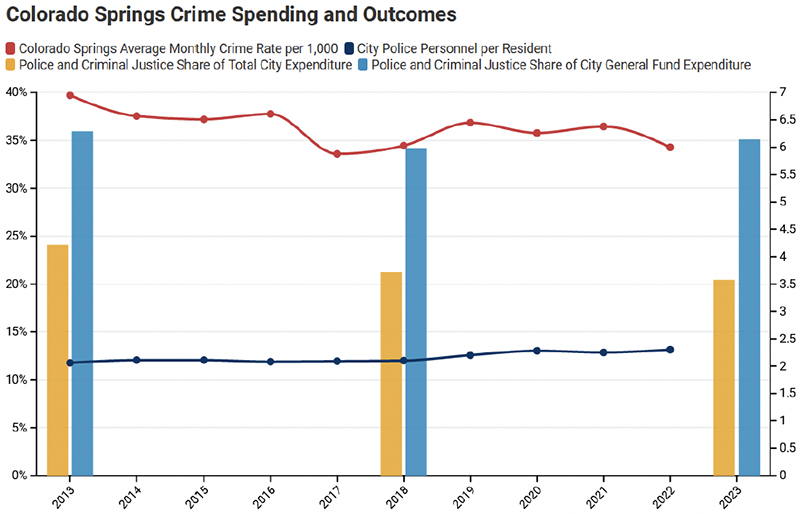

7. Public Safety

Together, the Police and Fire Departments' budgets account for 49% of the 2023 General Fund. Though their combined total budget has grown by $124.4 million since 2013, it has

declined as a share of total city spending from 37% to 30%. Total public safety spending was 55% of the General Fund in FY23.

8. Limitations of the Budget

Though the budget dictates the spending of all of Colorado Springs' governmental functions, its scope does not encompass all of the city's important policy issues.

The budget's influence on housing and homelessness, for example, is minimal.

CURRENT BUDGET AND CITY REVENUE

Of the $1,017,854,271 appropriated to be spent by the final approved 2023 budget, 41% comes from the city's General Fund, 19% from special revenue funds (largely voter-approved taxes), 22% from enterprise funds (fees and payments to government-owned businesses), and 17% from private and intergovernmental grants. 82% of all spending ($837 million) funds city departments, while the remainder goes directly to enterprises. In 2023, the Department of Public Works and the Police Department together are budgeted to receive well over half of the city's departmental funds.

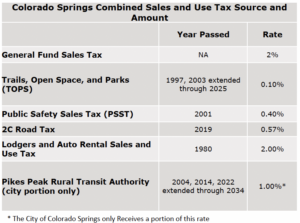

Unlike the city's special revenue and enterprise funds, the General Fund collects revenue through sources unrelated to what it directly supports— the 11 departments receive funding from the General Fund but do not directly generate the revenue that they spend. The General Fund's largest revenue source, by far, is city sales and use taxation (60%). Though property values have grown dramatically in the recent assessment cycle, the city’s revenue growth is restricted by TABOR and therefore will not grow at the same rate as the increase in assessed values.

$252 million of the $401 million in sales taxes collected by the city go the city’s General Fund. A combined $138 million comes from 3 voter-approved sales and use tax measures including Trails, Open Space, and Parks (TOPS), Public Safety Sales Tax (PSST) and 2C Road Tax. An additional $111 million in 2023 comes to the city through the Pikes Peak Rural Transit Authority (PPRTA).

BUDGET THEN AND NOW

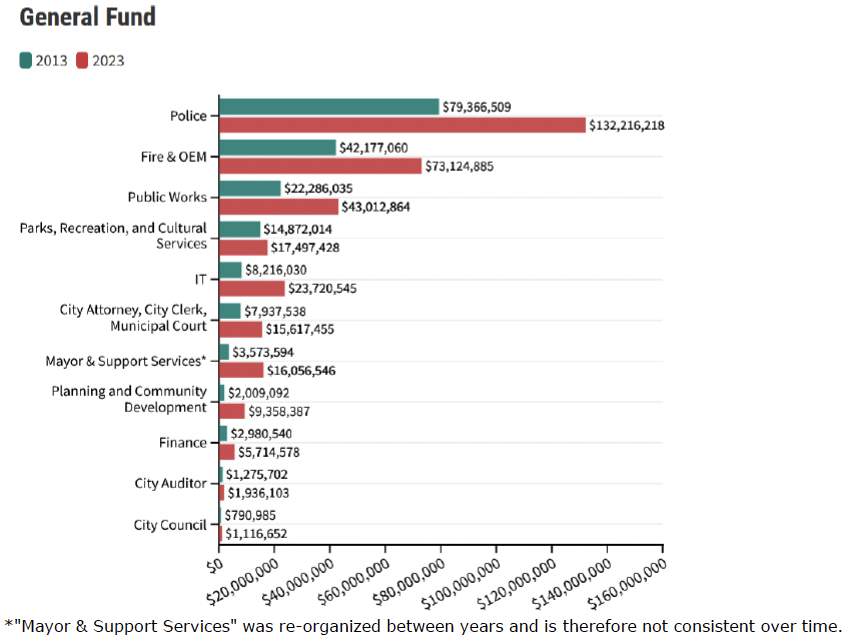

Expenditure by Department in 2013 and 2023

As is surely typical of growing cities like Colorado Springs, department expenditure has grown universally since 2013. The city's two biggest departments, Public Works and the Police, are budgeted to spend 327% and 82% more in 2023, respectively, than they did a decade ago. Some departments, like Finance and Parks, Recreation, and Cultural Services, however, now receive less inflation-adjusted funding than they did in 2013. Excepting Public Works, which has received an exceptional share of its new funding from other sources, departments' general fund growths have been roughly proportional to their total spending growths.

Colorado Springs Budget Expenditure per Resident

Values are adjusted for population and inflation

Between 2013 and 2023 the population of Colorado Springs grew by 13% or by more than 56,300 people. Inflation, as measured by the Denver Consumer Price index, grew by 38%. Inflation adjusted spending per resident, grew 59% over ten years. Most of this growth was through funds outside of the city General Fund, which grew just 16% on an inflation and resident adjusted basis. All other funds, including enterprises, grew a combined 116% over the last decade.

SHIFTING FUNDING SOURCES

Total spending by the Colorado Springs government has increased by 173% since 2013. Spending from the General Fund has increased by 73% over that period, but the General Fund's share of the city's budget has decreased from 57% to 46%. Over the last decade, the city government has come to rely more upon external grants and voter-approved revenue sources than it did historically.

DEPARTMENT FUNDING & FTE

Over the last ten years, Colorado Springs' government budgeted employment grew from 2,120 FTE (full-time equivalent) to 2,937 FTE. Actual agency employment levels will differ from the budgeted levels. The rate of the government workforce's growth (38.6%) significantly exceeds that of the city's total workforce (23.7%). The largest municipal employer, by far, is the Police Department, but its growth over the last decade was only 30.8%. FTE employed by the Department of Planning and Community Development, conversely, has grown by 251.6%.

DEPARTMENT FUNDING

Department of Public Works

- Public Works is Colorado Springs' largest department. It is primarily funded by grants and special voter-approved tax funds.

- Voter-approved funds account for $176.5 million of its total funding growth over the last ten years.

- The largest source ($112 million in 2023) of special funds is the Pikes Peak Rural Transit Authority, which was originally approved by voters in 2004 and recently reauthorized through 2034.

- Its total funding has grown by 327% since 2013, but its general-fund appropriation has grown by only 93%

- This reflects large transportation and stormwater spending increases.

- The city forestry department was moved under Public Works in 2022.

Police and Fire

- The Police Department and Fire Department/Office of Emergency Management are budgeted to spend a total of $281 million in 2023

- The Police Department budget is $172 million

- The total public safety share of Colorado Springs’ General Fund must be 47.65% per the public safety sales tax (PSST), however it was 54.53% in 2023.

- Inflation and population-adjusted police and fire spending per resident increased from $496 to $571 over the last decade

- Over the same period, though most Colorado cities' crime rates increased, Colorado Springs' fell

OTHER PRIORITY ISSUES

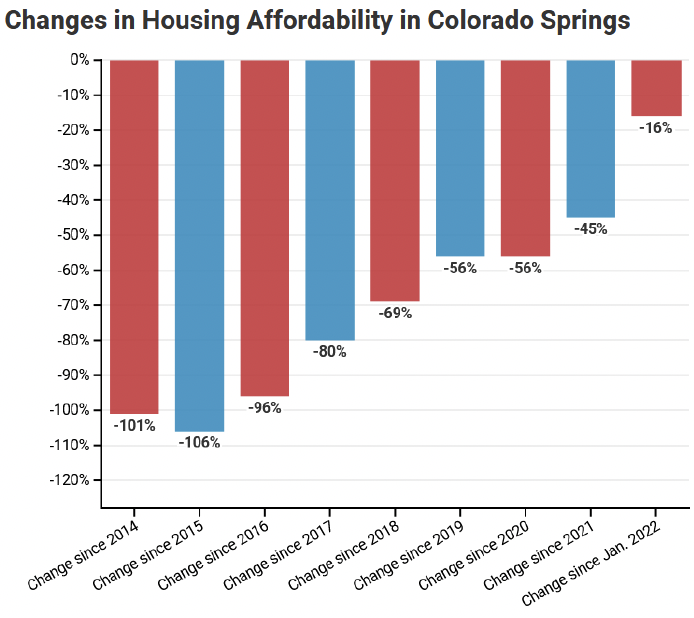

Affordable Housing

- The recently appointed Chief Housing Officer and the Office of Housing and Community Vitality Department within the Department of Planning and Community Development (DPCD) are principally responsible for designing and managing Colorado Springs' affordable housing initiatives.

- The Housing & Community Vitality Department is responsible for creating and implementing housing initiatives in collaboration with non-profit organizations and for-profit developers.

- The Department’s housing initiatives and projects are funded by a combination of city general fund and federal and state grants with the majority of Department funding coming from federal grant sources received annually from the Department of Housing & Urban Development (HUD).

- In 2023, the Department budgeted $7,520,182 in total funds, including $1,121,976 in general funds, to be spent on affordable housing, homelessness, and neighborhood improvements.

- In 2021, the Department began collecting bond issuer fees of ~$200,000 to fund an affordable housing fee rebate program authorized by city council.

Homelessness

- The Police Department, Fire Department, and Housing & Community Vitality Department are the departments of most responsible for response to homelessness and leading initiatives.

- The Fire Department 2023 budget includes $878,689 in grant funding for Community and Public Health, including the Homeless Outreach Program and the CARES program.

- The city’s Homelessness Prevention and Response Coordinator (1 grant-funded FTE) is included in the 2023 budget for the Housing & Community Vitality Department.

- The city government’s expenditures on homelessness response and prevention are small in comparison to the aggregate expenditures of local non-profits.

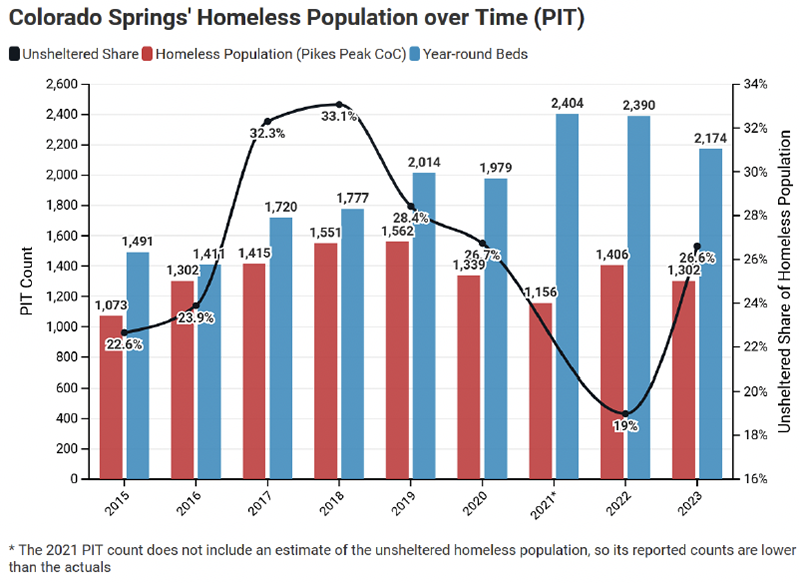

- Since 2016, the City of Colorado Springs committed $6.5M in federal block grant funds to the expansion of a low-barrier homeless shelter operated by a local non-profit. The expansion resulted in a rapid decline of the city’s unsheltered homeless population.