One year ago—in April 2020—Colorado lost over 360,000 jobs and experienced the worst month of economic performance in its history. Twelve months later, the latest data from the Bureau of Labor Statistics (BLS) show that, though Colorado's workforce is on its way to recovering from the worst of the recession, a lot of progress remains to be made.

Key Findings - Colorado April 2021 Employment Data (BLS CES Survey[1])

- Colorado added 17,000 total nonfarm jobs in April.

- At this pace, the state would reach pre-pandemic employment levels by Dec. ’21.

- To recover to pre-pandemic employment levels by January 2023—after adjusting for population growth—Colorado needs add 9,900 jobs each month on average.

- Total employment levels are down 4.6% or 128,600 jobs relative to pre-pandemic levels, ranking Colorado 20th in terms of April ‘21 job levels relative to Jan. ’20.

- New York ranked 50th and Hawaii 51st, in terms of current job levels relative to Jan. ‘20 down 9.7% and 15.1%, respectively.

- Idaho and Utah are the only two states that are above pre-pandemic job levels, having added 600 and 6,100 additional jobs, respectively.

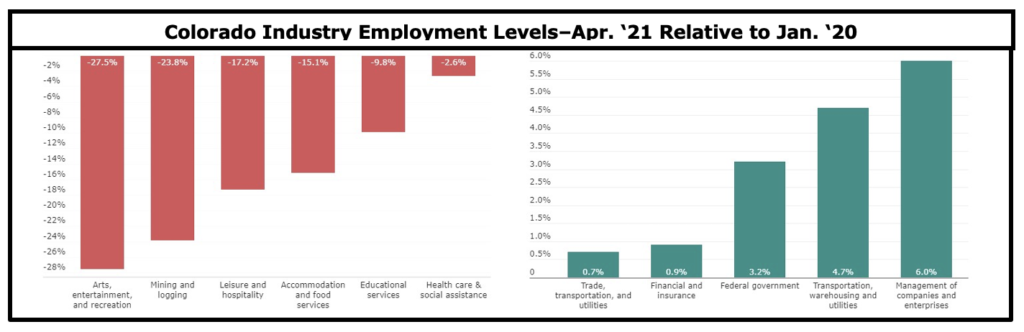

A Deeper Dive into Colorado Industries

- Some sectors in Colorado added jobs in April, while others lost

- Retail trade lost 700

- Leisure and hospitality added 9,900 jobs.

- Though leisure and hospitality has led the recovery by adding 22,500 jobs between Jan. ‘21 and Apr. ‘21, it is still down 59,800 jobs relative to Jan. ‘20.

- Arts, entertainment, and recreation is down 27.5% or 16,300 jobs.

- Accommodation and food services is down 15.1% or 43,500.

Colorado Labor Force Update

Colorado Labor Force Update

The Colorado labor force participation rate (LFPR) has nearly recovered, and the unemployment rate (UE) has remained steady for the second straight month. Though the recovery from the pandemic has been robust, some demographic groups have fared worse from others.

Key Findings - Colorado April 2021 Labor Force Data (BLS[2], FRED[3], and IPUMS-CPS[4])

- April’s LFPR increased to 68.7%, .2 percentage points above the month prior. April’s rate is .1 percentage points below Jan. ’20 LFPR, 68.8%.

- April’s UE rate remained at 6.4% for three months straight. April’s rate is 3.7 percentage points above Jan. ’20 UE, 2.7%.

- The monthly LFPR for Colorado women increased from 59.7% to 61.9%, however, it remains 2.2 percentage points below its pre-pandemic level.

- Nationally the female LFPR dropped 1.7 percentage points from 57.8% to 56.1%.

- If the pre-pandemic Colorado LFPR for women remained, there would be 54,400 more women in the labor force today.

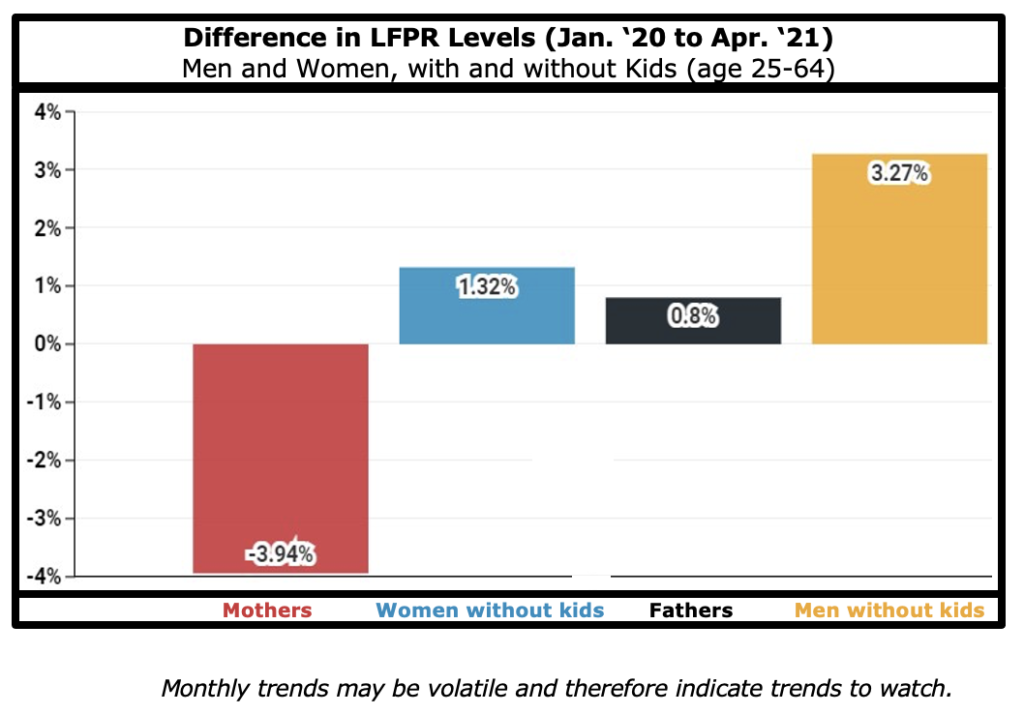

Women and Men, With and Without Kids in the Labor Force

- The LFPR for Mothers in Colorado was 76.2% in Jan. ’20, and as of Apr. ’21 was 72.3%, down 3.9 percentage points.

- Fathers, and men and women without kids LFPRs were all up in Apr. ’21 compared to Jan. ’20.

[1] https://data.bls.gov/cgi-bin/dsrv?sm

[2] https://www.bls.gov/

[3] https://fred.stlouisfed.org/

[4] https://cps.ipums.org/cps/